Het Financieele Dagblad, a dutch newspaper is reporting that eBay could be getting a 5% Adyen share options bonus as part of their deal to roll out eBay Payments to replace their PayPal agreement.

This is doubly good news for eBay as Adyen is highly profitable with an operating profit of €99 million last year on a net turnover of €218 million. With Adyen about to IPO if the share price rises as all expectations are that they will, then eBay’s 5% options will become increasingly valuable bumping eBay’s own share price.

ABN Amro reports that eBay will get €60.7 million from Adyen towards implementation costs and the marketplace has also negotiated more favourable rates on the expectation that huge volumes will be diverted to Adyen.

eBay will be awarded the share options based on performance and how much of their payments volume they divert to Adyen. As the default payment system on eBay has been PayPal there is little reason why most, if not all, of this payment volume will go through Adyen.

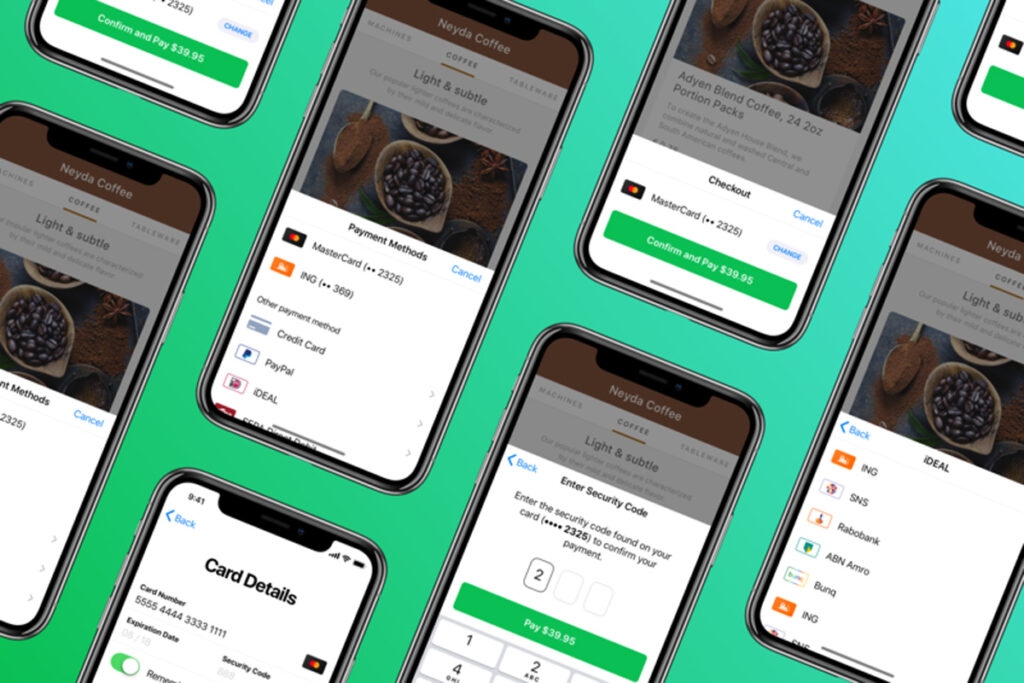

If we look at how Etsy implemented Adyen, previously Etsy allowed you to add your own PayPal account or other payment methods. Now they require all payments, including PayPal, to go through their own Adyen checkout so if eBay followed a similar path then there is no reason that they wouldn’t meet Adyen’s payment volume requirements. The only thing that can go wrong is how quickly eBay can roll out eBay Payments powered by Adyen to get the cash flowing through the right channels.