eBay’s third annual UK Retail Report is out today, revealing the biggest trends influencing Brits’ shopping habits and the performance of eBay over the past twelve months.

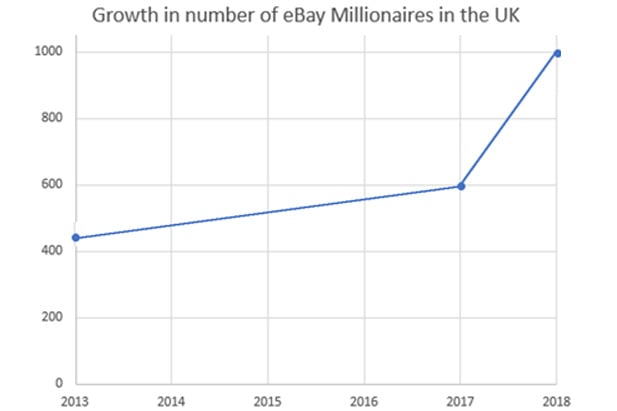

Headline numbers are that this year eBay turned 23 in the UK, created 1,065 new UK eBay millionaires and now has 24 million Brits visiting each week. Both these numbers are significant.

eBay UK market penetration

24 million Brits a month visiting eBay means that half of the eligible adults in the country shop on eBay or at least browse the site. Discounting children, there are about 53 million people in the UK so with 24 million visiting eBay regularly the marketplaces penetration of the UK is superb.

If you compare eBay’s 175 million active users and consider the population of the US at 326 million, less than 1 in 3 US citizens visit eBay and yet that’s the country the marketplace was founded in.

eBay Millionaires

eBay’s growth in the UK has been boosted by the eBay for Business program along with unique tools such as eBay Global Shipping and eBay Click & Collect. We’ve seen an acceleration in the number of UK businesses turning over in excess of £1 million a year on eBay since numbers were first reported back in 2013.

Germany is a big opportunity

UK small businesses on eBay are doing a roaring trade selling British fashion, antiques and sporting goods to our neighbours in Germany. America remains the biggest importer of British goods sold by small businesses on eBay UK, but in the last year, Germany has risen up the rankings to second place in the eBay Export Index – with the most recent research having found that the UK is Germany’s top destination for international shopping.

There has to be a note of caution here, we don’t know quite how Brexit will affect international trading but the chances are that regardless of any deals that may or may not be done between the UK and EU, eBay are likely to make selling as easy as possible for their merchants – eBay’s interests are directly aligned with their merchants in this instance.

“When it comes to shopping trends, if it’s happening in Britain, we’ll see it happening on eBay. Our UK Retail Report 2018, eBay’s third in the UK, gives unparalleled insight into how the nation has shopped over the last year. With 23 million Brits searching and shopping on eBay every week, we have rich data that reflects the trends influencing our nation’s trends and habits. Today’s eBay Retail Report reflects the value and variety that the 200,000 entrepreneurs operating on our UK marketplace bring to shoppers, both at home and abroad.”

– Rob Hattrell, Vice President, eBay UK

There are a ton of insights in the eBay UK Retail Report and we’ll be covering more in the coming days.

27 Responses

Just goes to show the absolute ignorance of ebay, a turn over of £1m doesn’t make you a millionaire. If you are lucky you will have made £100,000 from that turnover. There are a lot of people who could easily earn that in a job in London.

It’s the returns that are the problem on eBay, not the selling. The new service metrics penalty charge is what will eat away at sellers profit margins. With a 58% increase in fees that have started this month, the chances of making a profit are decreasing with the help of eBay, not increasing.

‘eBay’s growth in the UK has been boosted by the eBay for Business program’ this article has been written by someone wearing rose tinted glasses. Ebay for business sent me an email in June and July saying I was very high on my returns and would be eligible for a 58% increase. The last three month analysis is wrong they don’t corespond to the actual reasons the buyers gave. They count all return requests even though a high percentage time out without a return happening or the buyer opens a return to ask a question and then closes it.

One month my peers returns were apparently zero.

If the report was done by the same person who has created the returns metric penalty charge system, the true figures are probably totally different.

Shouldn’t be called millionaires, very misleading. Also doubt the data is correct, in just one year there is a big jump from 600 to 1,000.

Did they start off a Billionaires? Then the returns metrics penalty charge kicked in and they became eBay Millionaires.

24 million Brits a month visiting eBay, I do not believe that. Honest I hardly know anyone who uses it anymore.

Bet you all these so called millionaires are Chinese also.

I honestly would not believe anything in the report, ebay is in total decline, we are down over £70K with our eBay turnover in the last 18 months. It is rubbish, we have had to work really hard to diversify on to new markets in the EU which is really working for us so the big Brexit nightmare is really playing on my mind, I am losing sleep.

The UK is a low wage race to the bottom economy now on the verge of a crash as the latest debt cycle has reached its end.

23 million Brits a week visiting eBay.,,.. blah blah blah

Really?

Well how would you count our company who has to log in over 30 times a day as eBay keeps kicking us,,,,,,, as 1 visitor or 30 visitors ????

And Hack of the month goes to … Chris Dawson. Reads like regurgitation of an eBay press release. Any journalist with a shred of integrity questions the ‘facts’. eBay can’t be trusted to tell the truth about figures. It’s all spin. eBay are masters at double speak. How much did they pay you to write this?

Where have the visitor figures come from? Maybe the recent bug to make us continually log in boosted the figures? There were days when I was having to log in 10 times.

New millionaires? You aren’t a millionaire if your business turns over 1 million, you’ll be lucky to make 10% of that. eBay will have made around 20%. Please. Try looking into things instead of repeating what you are told.

Is 1,065 turnover millionnaires on UK Ebay really that many?

It actually is pretty low, when you consider the millions using Ebay and the fact we are talking turnover. You can be pretty sure Ebay has rolled in the shipping charges as well, as they do when they calculate those sales bar charts on the hub.

So why aren’t there more?

My guess is that most of these are established businesses, who happen to use Ebay as one of their outlets. To turnover a million on Ebay as a sole trader would be difficult, unless you deal in high value items.

The problem with most businesses on Ebay is, to quote the Dragons Den phrase, that they’re “not scalable”.

You are limited to the amount of stock you can get, the time available to process sales, post them and create new listings.

Over the years, we’ve seen Ebay slow down dramatically the speed at which you can list items. Partly this is due to increasing complexity of what data is required to list, but also the withdrawal of most of the tools that helped to speed things up, such as turbolister.

So it takes longer to list. It even takes longer now to add tracking. Add in the fee increases and becoming an Ebay millionnaire has never been tougher. And that’s before you mention how tough it is in general in the UK to make an honest living from a small business. Over-regulation, VAT, regressive NI for self employed etc.

If you are a genuine millionnaire entrepreneur, the truth is you probably don’t use Ebay.

Perhaps Ebay can look at helping more sellers to break that million.

Reining back on the fees, the complexity and simplifying the checkout would all help for a start.

That will be 66 normal business sellers and 999 arbitrage sellers each having 999,999 listings, ripping off customers with high prices, getting away with it by paying eBay a high percentage to sponsor their listings.

Probably now using the new eBay for Business program to promote listing, paying eBay even more money.

Tyler that is soo true. The listings are full of them now. Oh that and Chinese sellers that supposedly have a UK base. Funny that when you check the feedback, so many complaints about coming from China. Oh and those VAT numbers… checked out a few of them too, alot of fakes. As for non registered business sellers… well i report the same 50 every month. not 1 has changed to a business seller, not 1, in over 5 months.

Really anouying when you are looking for something and it brings up 18 pages of ‘from china’ first… only way to avoid is to exclude half the world!

All in all our turn over has gone up alot this year…. not that im any richer, just that ebay rules and regs, fees and the fraudulant claims culture they encourage has pushed up prices. So ebay win, i lose, buyer loses…. sellers fault, apparantly!

If i am totally honest i see ebay as a boat with so many patched holes that it will one day capsize. They are build profits on higher fees and giving less discounts, while subsidising it with turning a blind end to non registered business sellers and chinese fake location peeps. Can anyone really tell me that is is a substainable business model? Nope… this talking up the business is justa smoke screen for the real issues that are so easy to fix… if they really wanted to.

In the category I sell in on eBay, I found one Chinese seller who uses Salford University address as their own premises address and had registered their VAT against that address too. They also had complaints from buyers saying the seller was not in the U.K. Ebay like others are saying on this thread turn a blind eye to fake VAT numbers and bogus item location details even though buyers are regularly complaining about it.

From what I have read in other articles Ebay just make sure there is a VAT number filled in on the account but don’t check if it is authentic.

I would imagine some of these Chinese sellers are the once falsely being classed as UK high earners in the ebay report.