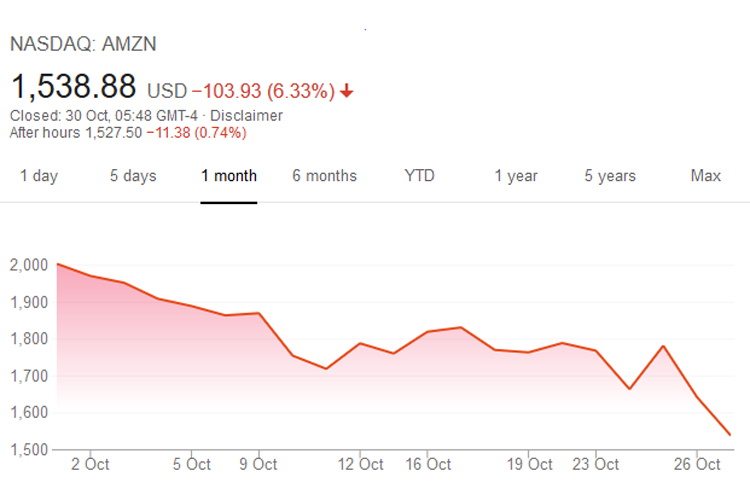

In September Amazon became the second ever company after Apple to have a market cap of $1 Trillion dollars. Since then they have lost a quarter of a trillion dollars and today have a market cap of just $750 billion.

We said at the time that Amazon isn’t really worth a trillion dollars and they also aren’t worth a quarter of a trillion dollars less. This is purely an amount based on future performance and the expectations of investors for future earnings. Amazon haven’t bothered themselves too much in the past about investor opinions, instead obsessively focusing on the customer and the customer experience and nothing has changed.

Amazon’s headline news in their latest Third Quarter Investor Earnings report is that sales were up 29% to $56.6 Billion. The problem with this is that investors were expecting more and their Fourth Quarter projections are also under investor’s expectations – this despite their actual earnings beating investor predictions.

Amazon isn’t in real terms worth less than they were a month ago, actually they’re worth a bit more because they’ve made a profit of $2.883 billion in the last quarter! Their market cap is entirely based on investor perceptions and the same is true in the case of eBay.

eBay‘s share price also plummeted recently when PayPal announced their latest earnings. PayPal cited a ‘softness’ in their eBay business and said it was only growing at 3% compared to PayPal’s overall merchant services which are growing at 28%. Investors immediately took that as a predictor that eBay earnings won’t be stellar and eBay’s shares took a dive and have fallen from $31.55 to $26.82 since PayPal’s announcement.

eBay‘s share price also plummeted recently when PayPal announced their latest earnings. PayPal cited a ‘softness’ in their eBay business and said it was only growing at 3% compared to PayPal’s overall merchant services which are growing at 28%. Investors immediately took that as a predictor that eBay earnings won’t be stellar and eBay’s shares took a dive and have fallen from $31.55 to $26.82 since PayPal’s announcement.

We’ll get to see eBay’s earnings when they announce the results of their third quarter at 10pm (3pm PST). If PayPal were overly pessimistic then eBay shares might bounce up or stay level as they’ve already felt the impact of expected poor performance. If however results are worse than PayPal’s indication then expect them to fall even further.

Share prices and market cap are of course important to companies as it can impact everything from the ability to raise cash to interest rates offered on finance but a companies value as determined by their share price isn’t a true indicator of their actual worth. Amazon’s net assets as reported in their Third Quarter earnings are actually $143.695 billion – a long way shy of a $1 trillion valuation and their assets aren’t even as big as the quarter of a trillion dollars they supposedly just lost.

One Response

Amazon share price c!osed below its 50 day moving average of $1670 and be!ow it’s 50 week moving average of $1580 that is why the share price quickly fell from $1670 to $1500 as automated trading systems sold below those numbers.

If Amazon is not worth a trillion dollars then Apple is not worth it, as Apple only has the IPhone which makes the majority of its profit. Where as Amazon is involved in many different businesses.

At $1500 a share it is worth buying Amazon with the intent to sell at $2000.