eBay have begun their phased approach to managed payments, moving to a future where eBay will manage payments for all sellers on their marketplace instead of PayPal being the default payment option. What everyone really wants to know however, is what eBay Managed Payment fees will be and if they’ll be higher or lower than PayPal fees.

First, the benefits, in the new payments model, eBay is providing consumers more payment options at checkout. Now, when buying from sellers enrolled in eBay Managed Payments, buyers can pay with credit and debit cards, just like with other online retailers. Apple Pay is the first new form of payment in the new payments experience and hopefully by summer 2019 PayPal will be available again.

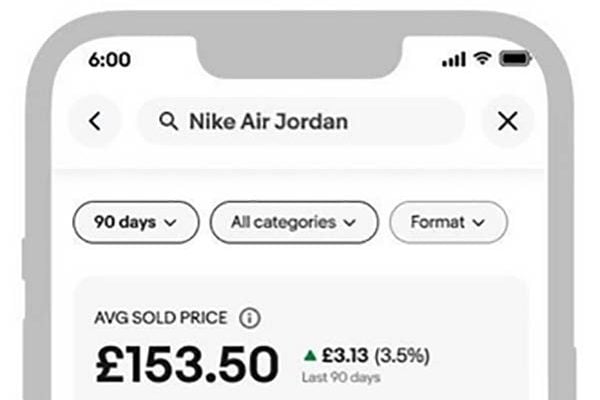

eBay Managed Payment Fees example from case study

Fees could be lower, eBay have recently published a piece on eBay seller honeville1, who says he’s saving $0.30 per transaction from lower eBay Managed Payment fees when compared to PayPal. In a month, he’s seen 150 transactions in three weeks and calculates a saving of around $1,500 per year on this basis.

honeville1’s 150 transactions need putting into perspective however, from his 2,396,682 listings, he’s sold 150 items in three weeks with an average selling price of around $20.00. That’s a turnover of around $4,000 per month, so he is a relatively small trader in financial terms. There’s nothing wrong with being a small trader but it’s important when we consider eBay Managed Payment fees and how they could impact larger eBay sellers. eBay have chosen a case study of a small seller to extol the virtues of eBay Managed Payments, probably because larger sellers are less likely to have opted in to the early trials but this also means that the experience won’t necessarily be the same for larger sellers.

What have eBay said about eBay Managed Payment Fees?

eBay had indicated that fees would be lower than they currently are with PayPal. What should sellers expect in terms of their fee structure?

“That’s correct. Most sellers can expect lower overall selling costs in the new payments experience, and all sellers will also benefit from a simplified pricing structure, more predictable access to their funds and better visibility into sales and payouts.”

– Q&A with Alyssa Cutright, Vice President of Payments at eBay

The important point to emphasise here is that ‘Most sellers can expect lower overall selling costs’. If most sellers are seeing lower fees let’s rephrase this to read ‘A small proportion of seller can expect higher overall selling costs’. Now let’s figure out who that small proportion of sellers are!

PayPal Fees and Merchant Rates

PayPal’s headline rate is 3.4% plus 20p per transaction, but the higher your total payment volume the lower the rate you pay if you apply for the PayPal Merchant Rates.

PayPal Merchant Rate fee table |

|

|---|---|

There will be no prizes for guessing that the vast majority of sellers are at the lower end of the PayPal Merchant Rate fees – there are a lot more smaller sellers than large sellers on eBay. Similarly the higher up the PayPal Merchant rate table we go, the fewer seller there are and at the negotiated top rate some sellers may be paying relatively low fees of 1.4% or less. Officially, in public, 1.9% is the lowest known fee so let’s work off that.

eBay Managed Payment Fees

We heard early in the roll out of the trial that eBay Managed Payments fees were 2.7%. We also know that eBay said those who signed up to take part in the Beta will get special discounted pricing for early opt in.

So sellers are paying 2.7% eBay Managed Payment fees and that may be a discounted rate for opting in early suggesting that, when eBay Managed Payments become compulsory, fees will be higher.

Which sellers will pay higher eBay Managed Payment Fees than PayPal fees?

If you’ve not already guessed what we’re thinking, it’s that the largest merchants on eBay will find eBay Managed Payment fees will be higher than their PayPal fees.

‘Most sellers’ means smaller sellers and the remaining sellers are by default the largest sellers on eBay. This means that the sellers who currently pay the highest total fees to eBay will see an overall percentage increase once they are migrated and start paying eBay Managed Payment fees.

A realistic eBay Managed Payments Fees example

If you’re currently paying 1.9% (or lower) PayPal fees and the introductory lower eBay Managed Payment fees rate is 2.7% than the difference is at least an additional 1.2% that you’ll end up paying, if not more. If your turnover is £50,000 a month on eBay then we’re talking an additional £7,200 per year (or more) in increased fees.

If actual eBay Managed Payment Fees turn out to be higher, or if you’re turning over £millions on eBay per year, then the fee increase is going to be considerably higher.

Disclaimer

eBay haven’t yet announced the final fee structure for eBay Managed Payment fees. We could be wrong and eBay could make arrangements not to stitch up their largest sellers with an unwelcome fee increase. Perhaps they’ve realised that volume discounts are the norm and that those who put through the highest revenues through are accustomed to paying the lowest fees and will make adjustments.

We’ll wait to see, but if most sellers are likely to pay lower eBay Managed Payment fees than they currently pay in PayPal fees, who do you think the few are that will end up paying higher fees?

20 Responses

Have any of the really big sellers signed up yet?

I bought from musicmagpie the other week and they still accepted paypal, so that’s the biggest seller not taking part yet. Anyone bought from worldofbooks? I’d imagine they’re still taking paypal too, as it doesn’t make any financial sense for anyone on anything above the paypal standard rates to sign up for ebay management payments until ebay forces you to.

But….

We always hear whining on here about how ebay only looks after the big boys, doesn’t care about the little seller. Here, although ebay is doing something primarily for themselves, they are doing something for the little sellers and definitely not the big boys, who aren’t going to be happy when their costs eventually go up.

Gav…. you appear to be tarnishing all larger sellers with the same brush! I wouldn’t exactly call £6k a month a big seller in the online world. Is a hammer and nail approach to ebays issues with large sellers rewally the answer? Surely there are far fairer ways to address the issue. Lets face it, anyone in retail, whether online or on the high street etc will be faced with the little guy big guy senario. It is not limited to just ebay. Ebays issue is its answer to any of its issues with are normally focus around things taking more time, more freebies for buyers and lower discounts, all of which naturally hit smaller sellers more. they never think about that…

what i want to see is a fair system. Although paypal fees are high, the disocunt structure is fair. the more you spend with them the cheaper the fees… that is life. You buy one can of coke and it will cost more than if you buy 24 ( well per can anyway).

I’m still supicious of this new system though… when has ebay ever done anything that has put sellers first, or atleast on an even playing field with ebay when it comes to financial interests? For years they have just seen us sellers as a constant stream of income to make up for their lack of basic retailing ability! I doubt this will be different. As ebays revenues faulter so the fees will go up, as with every other aspect of ebay. One day you will get 5 sellers being charged millions of FVF as they only have 5 sellers left…. but still dont get the issue!

Hi, from the statement “honeville1’s 150 transactions need putting into perspective however, from his 2,396,682 listings, he’s sold 150 items in three weeks”. His not really a proper seller his just drop shipping from Amazon and putting them on Ebay, which I thought was against Ebay rules, as no likes to receive a box with Amazon written on it clearly pointing out that this available cheaper on Amazon, driving more buyers to Amazon in the long run ! No one carries 2 million + items and sells just 50 items a week!!! I really annoys me that the actual real sellers of item on Ebay are just being driven down the listing by dropshippers paying for advertising to appear above the real sellers. . And item that should sell for £6 are appearing at the top of Ebay search for £10. This is not good in the long run for anyone. It just another nail in Ebay coffin as it becomes more irrelevant, accepts short term advertising revenue over promoting proper sellers that offer good service at good prices.

I realised the potential fee hike and commented on it a couple of weeks ago on Tamebay, we currently have a rate of 1.4% + 20p on Paypal so any increase is going to be quite significant.

On another note, I have spent most time this week looking at alternative selling channels for the first time ever, I have been selling on ebay for 12 years and never had any reason to use other channels and have always been very pro ebay, as much as I try not to, I find myself losing faith in ebay week by week and now worry about having all my eggs in one basket.

We sell reasonably high value kit on eBay. About 150 sales is all it takes to gets us into the 1.9% +20p Paypal rate.

It’s looking like more bad news from eBay for us…

There is no mention of any additional fee on top of the 2.7% like PayPal do with the extra 20p or in our case 5p for Micropayments.

Does this mean that this additional fee on top of the % charge will go?

The big boys can easily afford these increased fees.

We have a friend who works in the listings department for a huge retailer on eBay and they source an item for just £3.06 the same item we source for £10.09. We understand that they buy 10’s of thousands so get a huge discount but here is the thing when they see our asking price on eBay of £22.99 they don’t hammer out what hey need which he says is £6.75 they set it at £19.99 making a huge mark up on their normal price but looking pretty damn good to everyone looking on eBay. So then they offer the world.

Free shipping.

Free Returns.

60 Day returns, and can get away with giving a 50% refund if its returned unable to be resold. Unlike the small retailer like us working on a 15% margin just to remain n the game.

So a small hike in fees is not going to hurt them at all.

After all now we have not even sold an item until it has been gone for a month without being returned. So sell a £200 slow selling item and will you dare replace it on your shelf for a month in case the other comes back and now you have 2 sat there on the shelf tying up capital and one is more than likely not re-sellable.

I know where my wifes next wedding outfit is coming from temporarily of course. Small TV for grannies room over Xmas, no problem, in fact one for every room over Xmas

This will not hurt the huge companies using eBay as a big advertising shop window for just 10% of each sale which is making more than they need in profits anyway and it’s cheaper than the millions they spend on TV advertising.

He told me they are not on other platforms as they all will not blow smoke up their backsides and give them huge discounts for standards that we little sellers struggle to achieve. But with more platforms appearing all the time maybe this is eBays final desperate lunges towards saving themselves. As when the little sellers disappear the eBay window will not look as attractive to buyers as they can just go directly to the big boys own high street stores or websites and even look for more diverse things on the other platforms.

So hopefully we can hang on till retirement and it seems likely as other platforms sales are increasing each day in comparison to eBays which are falling.

More payment methods should be a good thing. As always devil will be in the detail. If 2.7% captures everything including transaction costs and cross border fees I would be reasonably happy, and will probably come out slightly better than Paypal. Paypal has a lot of hidden costs, and is quite expensive for low value transactions. Overall my Paypal costs come out closer to 4-5%, due to low value items.

Currently very hard to compare. Presumably it is 2.7%+VAT through Ebay, which as far as I can see for small non-VAT registered business sellers means costs will be on a par with Paypal. I’m VAT registered but on a flat rate scheme, which I can stay in until £225K turnover, so I won’t be able to claim any VAT back. Overall the flat rate scheme works out slightly better and saves me lots of paperwork, but that’s another 20% on top that I need to cover from my top-line sales.

I generally sell between £12-£16K a month through Paypal, mostly Ebay. The above article suggests I’m a ‘large seller’, which really isn’t right. After all costs, including holding stock, are covered it really only provides a modest/normal sized income. I can’t see how anyone with lower turnover is making much of a living on Ebay??

I would class myself as a small business seller. The type of seller that really should be better off as a result of this, but my experience in the last few years is that Ebay uses every opportunity to eek out another few % here and there.

Sadly, it is also driving lots of dishonest sellers with very high postage rates, drop-shippers or other types of businesses without any stock, as well as business sellers pretending to be private sellers not paying any tax at all. You’d think it would in Ebay’s long term interests to weed these out, but it seems they are just short-termist about it and ‘addicted’ to their FVF. Sellers are firmly bottom of the pecking order behind shareholders and buyers.

Ebay also don’t allow sellers to trial the new payment system. Once you sign up they don’t allow you to cancel it and go back to PayPal if you have issues with it. They could effectively put fees up and your business account would have to just pay the new rate. Your only option would be to open a new business account and start from scratch again with PayPal as your payment choice.

The sooner online market places are regulated the better.

Maybe the new Ebay managed payments system is a blessing in disguise. Currently Ebay is not covered by the Financial Ombudsman, eBay says it cannot sign up to the Ombudsman service because it simply operates a marketplace for others to use.

PayPal has voluntarily signed up to the Ombudsman’s service. If Ebay sign up too at last we have them accountable to someone. And if they are managing payments wouldn’t you want them to be accountable to someone?

“If you’re currently paying 1.9% (or lower) PayPal fees and the introductory lower eBay Managed Payment fees rate is 2.7% than the difference is at least an additional 1.2% that you’ll end up paying, if not more.”

Your math is off there – 2.7% – 1.9% = 0.8%. Still an increase, but not the 1.2% in your story. That’s also partially offset by the elimination of the per-transaction fee, so sellers with lower average transaction prices will see more of a benefit from the elimination of that fixed fee while higher average prices will be more impacted by the percentage rate.

2 million listings and he sells 50 products a week. That’s a monthly average conversion ratio of around 0.008%. I can’t possibly fathom why eBay would have picked this guy to evaluate. Surely eBay wouldn’t want a marketplace full of sellers listings 2millions items EACH and only selling 0.008 of them per month. That would be damn right ridiculous.

It needs to be remembered that the move to Adyen is not for the benefit of sellers.

It’s to boost Ebay’s bottom line, following their unsuccessful attempts to find a formula to boost sales, or even a coherent and consistent plan to get there.

Any benefits to sellers will be purely co-incidental and, probably, short-lived.

Given Ebay’s recent fee raising, sellers can expect the payment to rise in future as well.

The only upside, potentially, is offering customers a wider choice of payment options, other than just Paypal.

eBay will do this:

A) Make Adyen mandatory on all listings

B) Make Adyen the default payment option

C) “Bundle” Adyen in with the Final Value Fee

The seller will be deceived with an initial* promotional option e.g. “Switch to Adyen and pay only 12%** FVF and no other payment fees***.”

* The initial rate will show a comparison table between eBay’s offer without VAT and PayPal’s uncompetitive pricing on a low value item.

** The 12% will be linked to service level metrics set by eBay, most likely with a “falsified comparison set” to ensure it rises.

*** The bundle is a sting.

How it will work is this.

The seller will be given an option e.g. EBAY all-inclusive payment for 12%. No other payment fees.

However, if you would optionally like to accept PayPal or Debit Cards these will be available for let’s say 3%.

On top of the 12% you are already paying.

eBay’s mouth will be fed with a payment titbit whether they process the payment or not.