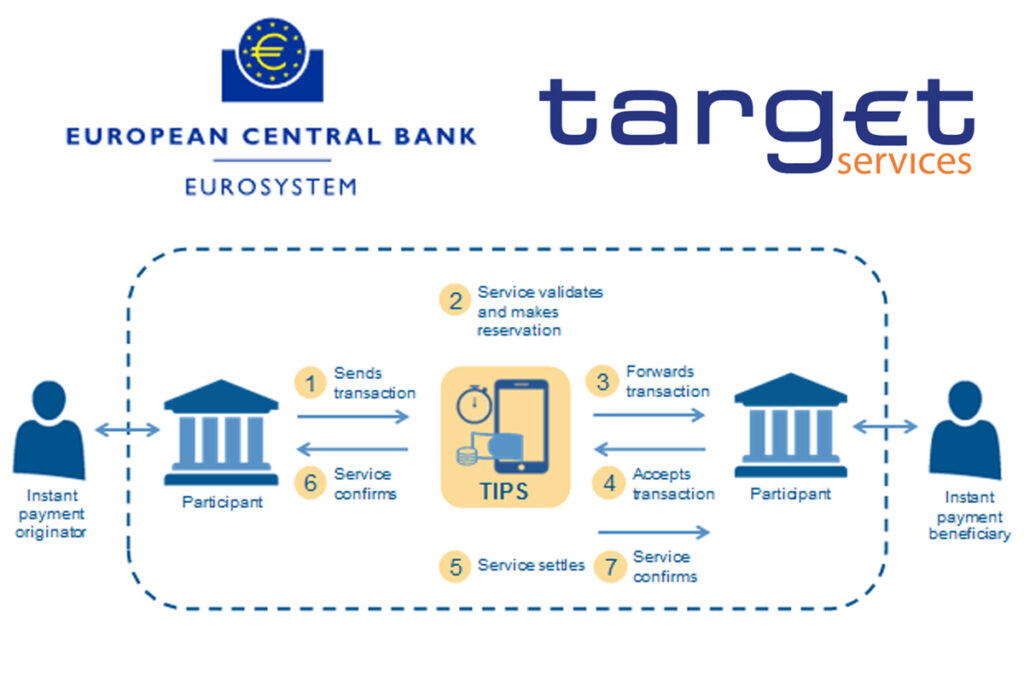

The European Central Bank (ECB) has launched an instant Euro payment system designed to compete with the likes of PayPal. TARGET Instant Payment Settlement (TIPS) is a new component of the Eurosystem’s TARGET Services and aims to enable banks to offer fund transfers in real time and around the clock, 365 days a year.

“We need to address the reasons for the scarcity of major European players in the payments market”

– Yves Mersch, Member of the Executive Board, ECB

PayPal, Google, Facebook, Amazon, Alibaba and Tencent are the only mainstream providers of instant payments and none of these are European organisations. The ECB want to make instant payments easy and are inviting all banks to join their network as well as other payment providers.

PayPal have already come under fire in the UK over their acquisition of iZettle with the Competition and Markets Authority (CMA) concerned that PayPal’s takeover could lead to higher prices or reduce the quality of the services available to customers.

Again in the UK, Barclays Bank are protectionist and still Barclays customers can’t use the Google Pay with the bank forcing customers who want to make mobile contactless payments use their own services.

Whilst the UK aren’t a part of the grand Euro experiment and soon might not even be in the EU due to Brexit, it’s likely that online merchants will still benefit as TIPS will be open to global players and intended to address the reasons for the scarcity of major European players in the payments market. One might expect the major marketplaces to enable TIPS payments through their payment partners or own in-house systems.

As with all payment systems, the success of TIPS is likely to be driven by consumer adoption rather than bank and marketplace initiatives. A decade and a half ago when eBay acquired PayPal it wasn’t simply because they needed a payment system, it was because eBay users had already voted and were using PayPal anyway. If European consumers want to use TIPS then marketplaces will be more or less forced to adopt the new offering.

One Response

seven years too late