Sellers trading in the US have to comply with the eBay US Sales Tax Collection which requires them to collect taxes on their transactions when trading in certain states.

eBay said yesterday that they will support sellers affected by the June 2018 Supreme Court decision. They said that they will collect tax on sellers’ behalf in the following states:

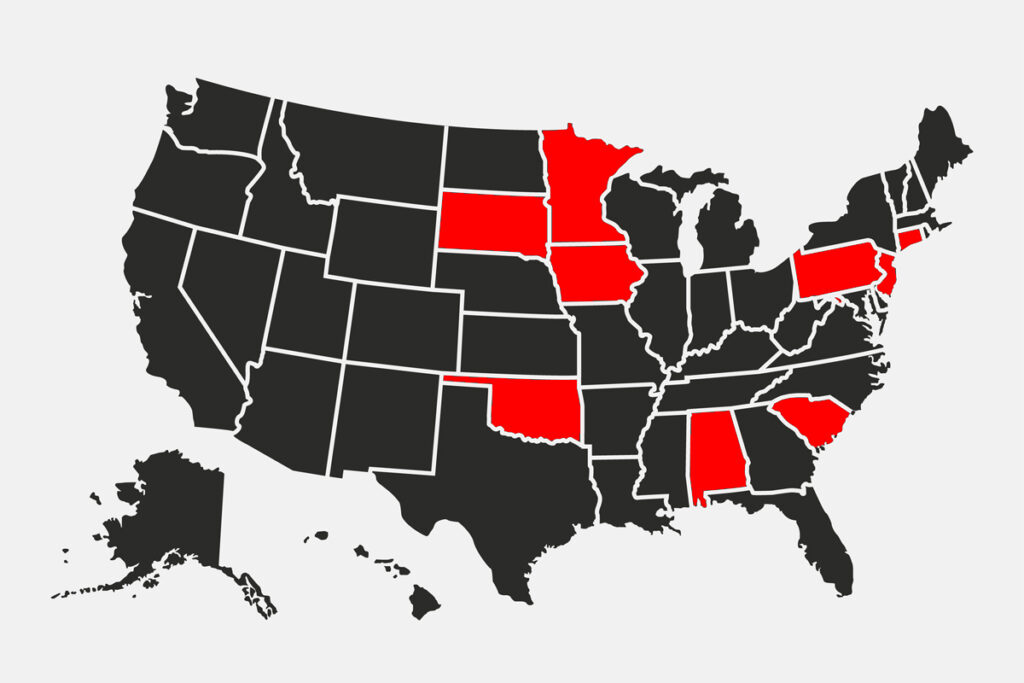

eBay US Sales Tax Collection States

- Minnesota – 1st of January 2019

- Washington – 1st of January 2019

- Iowa – 1st of February 2019

- Connecticut – 1st of April 2019

- New Jersey – 1st of May 2019

- Alabama – 1st of July 2019

- Oklahoma – 1st of July 2019

- Pennsylvania – 1st of July 2019

- South Dakota – 1st of July 2019

- South Carolina – 1st of October 2019

Sellers in Massachusetts and Vermont

Massachusetts and Vermont use a threshold of $600 and don’t have a transaction threshold. This means that sellers which reside in one of these states will get a Form 1099-K if their gross payments equals or exceeds $600, irrespective of the number of payments they receive.

eBay will also report this amount to the Massachusetts or Vermont tax authority as applicable. Sellers should note that their gross payments won’t be reported to the IRS unless they exceed $20,000 in gross payments and have more than 200 transactions.

eBay US Sales Tax Collection on eBay sales

Some merchants might be required to change their sales tax to comply with the policy. Sellers can set up a tax table and apply it to their listings. eBay then will add the tax to the buyer’s total at checkout.

Merchants should contact a tax professional to determine whether they need to charge sales tax on their eBay sales.

How to set up tax tables for eBay US Sales Tax Collection

Merchants can specify a sales tax rate for each US state in which they’re required to charge sales tax. They can also charge tax on shipping and handling, if it’s required by law.

Buyers see sellers tax rates on the listing page. Once buyers confirm their shipping address at checkout, eBay automatically calculates the sales tax amount and add it to their order total.

Here’s how to set up a tax table:

- Go to Site Preferences in the Account section of My eBay.

- In the Payments from buyers section, select Show.

- Select Edit in the Use sales tax table section.

- Fill in the sales tax rate for any state where you want to charge sales tax. If you’re also required to tax shipping and handling in that state, select the Also charge sales tax on S&H check box.

- Select Save.

Important things to keep in mind when setting up a tax table:

When sellers list their item, they need to indicate that they charge sales tax in the listing form and associate their tax table with the listing.

Changes that sellers make to their tax table won’t be reflected in their live listings. Merchants will need to revise any current active listings for their tax table changes to apply to those listings. Listings created after sellers have saved their tax table changes will reflect their tax table updates.

Once merchants have created their tax table, they need to specify in their listing that they are charging sales tax. Here’s how:

On the listing form, sellers can check the box beside charge sales tax according to the sales tax table. They can open and make changes to their tax table by selecting view sales tax table. Complete their listing and select preview listing or save and continue later.

3 Responses

How does this apply to UK sellers? Etsy add on to the sum the buyer pays and pay the money directly to the relevant authority. Will eBay proceed likewise?

For the states where eBay is collecting the sales tax on behalf of the seller, there is nothing the seller needs to configure or do differently. eBay will be collecting that and remitting it to the proper state agency, so no configured tax table option is necessary. Only if there is a need to collect tax in one of the other states not currently covered by eBay automatic processing is there a requirement to configure your own tax table to have eBay collect that from the buyer at the time of checkout and payment.

More info can be found here: https://channelx.world/2019/04/ebay-collect-internet-sales-tax-sellers.html