SellersFunding, recognising that banks haven’t been traditionally adept at providing small business finance for online retailers, set out to create a solution to match sellers with funds from financial institutions and to make the whole process seamless.

SellersFunding, recognising that banks haven’t been traditionally adept at providing small business finance for online retailers, set out to create a solution to match sellers with funds from financial institutions and to make the whole process seamless.

Designed with online merchants in mind, they even have a loan where it’s interest only for 90 days – recognising that you only start to make money when your stock arrives even though you might need capital to pay for the stock several months in advance.

We spoke to Ricardo Pero, CEO of SellersFunding, to find out more

Who are SellersFunding?

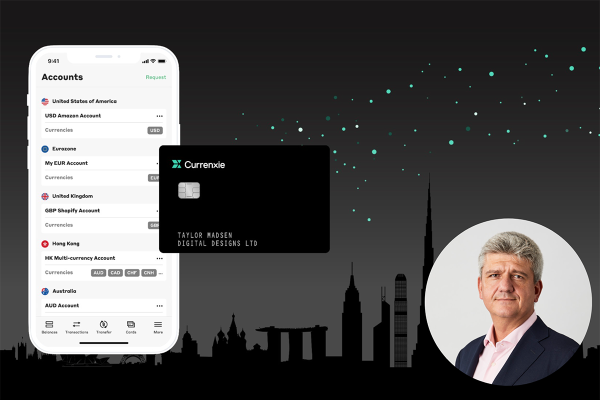

It began with my personal desire to start a business where I could combine years of work experience in the financial industry with my desire to learn new things related to technology. Now our company, SellersFunding Corp., is a data driven online alternative lending platform that offers a fully integrated application for funding and multi-currency payments to market place sellers. We aim to become a leading provider of a global risk assessment solution for marketplace sellers across geographies and marketplaces.

SellersFunding leverages its experience in data modelling, machine learning, deep learning algorithms, data mining and financial modelling to offer funding and payments solutions via a seamless and fast application process that empowers these small businesses to invest in their growth.

What is the problem you aim to solve

Help new businesses to prosper through financial innovation. Marketplace sellers run into issues such as limited credit solutions, inefficient credit models, high transaction costs, and low margins. However, with SellersFunding, we offer a new credit solution that bases their credit off of performance, rather than personal credit, a low-cost FX conversion service, which in the end, increasing the Seller’s margins.

How has your platform been built?

Our platform, SellersFunding App, feeds off of our AI based models that connect billions of data points from Amazon and Shopify covering thousands of App users. The App was engineered to create a streamline connection directly to the Seller’s Amazon account, facilitating the application, approval, and communication process. Offering a combination of risk assessment, application and risk monitoring tools with a fully integrating lending and payment solution to marketplace sellers.

Tell us about your success in the US

We have 10,000 users after just 12 months

What does your UK launch mean for UK merchants?

UK merchants will now:

- Get flexible funding terms based on their sales performance in USD, GBP, EUR and CAD

- Access funds in 48 hours

- Optimize their return on capital according to their cash flow needs

- Maximize their ROI

- Prioritize investments in inventory purchases

- Simplify their cash flow management knowing they have readily available funds based on their sales metrics

- Make payments in 35 currencies across more than 140 countries

- Monitor their risk score and build their credit score for their business

They will benefit from the transparency and access to better and more competitive sources of capital, delivering the tools where small business owners would be able to build a credit history for their business independently

Tell us about your 90 day Interest-only Term Loan?

Our Term Loan is an interest-bearing product that starts at a 14.99% APR and funding amount can go up to $500,000. The final interest rate is determined by your recent company performance, as well as the term you were seeking. The security for our Term Loan is a Personal guarantee. The requirements for this product are a minimum of 6 months on Amazon with at least $30,000 in sales during that time. We also offer interest-only payments for up to 90 days.

What should merchants do next?

Merchants should apply for pre-qualification for their next Term Loan or Revenue Advance with us and invite other Merchants to participate.

20% discount for Tamebay readers that make the switch to SellersFunding!

For a limited time, we’re offering Tamebay readers a 20% discount to what you pay your current foreign exchange provider if you sign up. Open a SellersFunding account today!