From today, the self-employed can start to claim under the Coronavirus Self-Employment Income Support Scheme (SEISS). Not everyone will be able to claim SEISS today, but you can register to make a claim and will be given a date over the next few days upon which you will be given access to complete your claim.

Evidence you must keep for SEISS

It is very important to note that if you claim SEISS you will need to keep evidence that your business has been adversely affected by Coronavirus and confirm your income suffered as a result of the Coronavirus. The Government are well aware that this scheme is open to fraudulent claims and will be carrying out investigations where they think fraud has taken place. They will expect you to keep records and provide on request evidence of the following to support your claim:

- Business accounts showing a reduction in turnover

- Confirmation of any Coronavirus-related business loans you have received

- Dates your business had to close due to lockdown restrictions

- Dates you or your staff were unable to work due to Coronavirus symptoms, shielding or caring responsibilities due to school closures

Reasons your business saw a reduction in turnover to justify claiming SEISS could include:

- When you were unable to work because you:

- were shielding

- were self-isolating

- were on sick leave because of coronavirus

- had caring responsibilities because of coronavirus

- When you had to scale down or temporarily stop trading because:

- your supply chain has been interrupted

- you have fewer or no customers or clients

- your staff are unable to come in to work

Bear in mind that you may not have to provide this evidence until after you tax return is submitted in January 2021. The SEISS provides grants not loans, but that won’t stop HMRC pursuing anyone who they believe has claimed fraudulently.

“We are building checks into the self-employment support scheme to prevent fraud. Only those already known to HMRC through tax return data as self-employed will be able to apply.

We already have a wide range of statutory and common law powers to tackle fraud and criminality, which will be used.”

– HMRC Spokesperson

Reporting your SEISS Grant

The SEISS grant is taxable and may affect other payments you receive such as Universal Credit and Tax Credits. You will need to report the grant:

- On your Self Assessment tax return

- As self-employed income for any Universal Credit claims

- As self-employed income and that you’re working 16 hours a week for any tax credits claims

How to claim SEISS

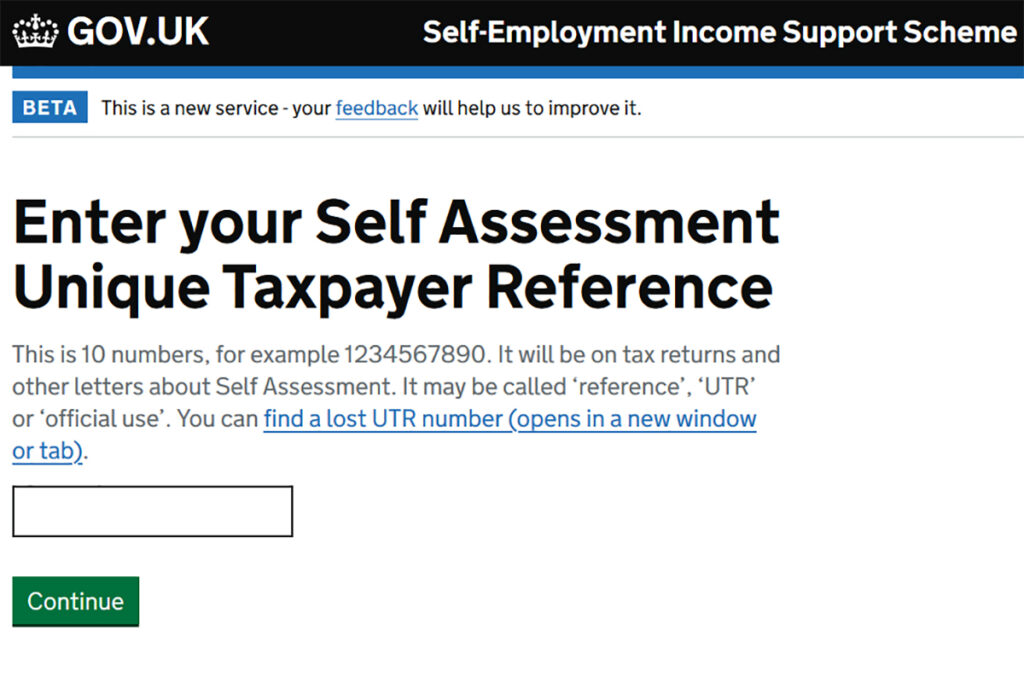

In order to claim SEISS you will need your:

- Self Assessment Unique Taxpayer Reference (UTR)

- National Insurance number

- Government Gateway user ID and password

- UK bank details

The first step towards submitting a claim will be to complete the HMRC online tool to find out if you’re eligible to make a claim.

31 Responses

Must think were daft

Hmrc nay possibly prosecute the worse offenders or the stupid

otherwise its open to rampant abuse

Government is throwing money at this

In desperation

A Massive financial virus is on its way,

With fiscal ICUs overwhelmed

Is this (and the previous article about the grant) based on any actual evidence or is just supposition and opinion?

The previous one in particular with your list of who should not apply seemed to be just your opinion without an official HMRC source to back it up.

I have been been working self employed for over 3 years but didn’t take much in this current year as I’ve been out of work with injuries and working when I can and where I can.

I didn’t claim any benefits as I was preferring to work than claim benefits.

I had work in April/May of 2019 and work in December/January of 2019/2020 and was picking up work here and there and considering a new line of work, still as self employed, when Covid hit and now there was no chance of work.

Am I allowed to claim ? HMRC contacted me and told me I was permitted. I don’t want to commit fraud.

I’ve also dedicated a lot of time to helping my 86 year old land lady who was basically isolated and has been alone apart from me for the past 7 weeks and she can attest to that.

I looked at the form yesterday.

The form stated:

Your business could be adversely affected by coronavirus if, for example:

you’ve had to scale down or temporarily stop trading because:

your supply chain has been interrupted.

At least 2 of my suppliers locked down so I could not get stocks.

My main supplier continued as normal.

My main product lines sold well – in line with 2 years ago (last year was not so good), however, I could not sell stock I did not have, so my overall turnover would have been higher without the CV problems. How much higher I do not know, as I do not separate out sales from different suppliers in my records.

I did not see any requirements to prove a reduction in turnover on the application, as I may not be able to do this.

My problem is that I have put a lot of time and effort into increasing my range of products from my main supplier, in order to make a big leap in overall turnover this year, so I would not expect to see a decrease, but perhaps I would have seen the big leap without CV.

I have never claimed a penny in benefits in my life, so would be somewhat aggrieved if I could not claim this, especially if my taxes and NI go up to pay for the country’s bailout.

I really don’t want the boys from HMRC kicking my door down, so cannot make up my mind if I should claim.

I work as a labourer who is “self employed”. There is nobody hiring these past few months and I have continued to incur expenses for garage rentals and tool purchases. SO I can show that.

I know a self employed builder, he has told me that he ‘is busier than ever during this lockdown’ and is working 7 days a week. However, he told me that he has every intention of claiming up to £2500 monthly under the SEISS. He will just not include the jobs that he has done on his trading books. How can that be right?

Please supply a link that mentions you can only claim SEISS IF IT EFFECTS PROFIT.

You can claim SEISS and earn 10 times as much as you did last year, In-fact it actually encourages you to claim and WORK. (it does not say claim and work but only earn 20% of you usual income lol)

“you carry on a trade which has been adversely affected by coronavirus”

https://www.gov.uk/guidance/claim-a-grant-through-the-coronavirus-covid-19-self-employment-income-support-scheme#check

Making 10 times as much as you did last year, can hardly be described as adversely affected by anyone other than a complete moron and I’m sure you are not a moron.

morally its not good . However they have said for SE there are no work restrictions. While claiming the SE grant. Even if we ASSUME they mean profit /turnover that can change after getting the grant.

Furthermore When does your business have to be “Adversely effected” . At no point does it say WHEN. Is it only march april may? Should you leave claiming until you see the full effect?

There are allot of question and ambiguity.

When you say there are a ‘lot of questions and ambiguity’ you should say there will be a lot of fraudulent claims 😀 😀

People who don’t need it can’t wait to justify a reason to claim so that they don’t miss out on free cash. Those that truly need to claim find it very easy to justify.

grown ups should know whats right

I know a person who applied for SEISS but never stopped working , business was never affected and fell into this persons pocket 3000£ for free.

As a key worker I put myself at risk of going to work every day and feel angry that money from our taxes are given out this way.

I will not report this person because I can’t.

But I would like to hear that the government has some ways to detect thieves.

Will HMRC be able to find that the business was never affected but the SEISS was collected at the end of the tax year?

Working with many people through this period (may be a week off)

I now see most are now contemplating how to spend there Government lottery win.

I applied for the SEISS as I am fast food moped courier and since most restaurants/clients got closed I was definitely affected as I was getting less jobs.

But, I managed to do the same money on a weekly basis as before because I found another similar job and also I was spending more time on the road…

So, my question is: Is it providing a proof of the restaurants being closed enough evidence or I have to declare any income reduction?

I am asking that question because my accountant told me that HMRC haven’t stated anything about income reduction but just that the business should be adversely affected by the CoViD19?

I have been told of a company that have so called subbies that work continuously and have not stopped working for the same company, all the guys on the books are on the furlough Scheme, on 80% pay, A good few of these subbies have claimed the SEISS, amounting to £6000 each, will they be in for a shock later on, they are all paid through the company, not cash, will they getaway with it .

Hello, I’ve been effected by covid and made a claim (very small one). I’m self employed and work varies month to month. But my question is: what if I see record profits this year as I’m a growing business? Work is now picking up again and I’m worried further down the line I will be in trouble, because I could end up have a good year work wise! Is there a way of paying it back if this happens? Don’t want to get fined!

Thanks

I’m self employed only working 3 days a week . That’s 24 hours instead of 40 . Is there a definite guideline on the hours that suggest adversely affected, in my estimation it is. A lot of people are out of work completely so hoe do we justify.