In this five part series, in partnership with Cdiscount, we will examine the French ecommerce market and explore what UK sellers need to know about selling in France. In our first post we looked at the state of French Ecommerce:

The State of French Ecommerce

2019 was a big year for France as it crossed an important milestone: ecommerce sales of both products and services passed €100 billion to reach €103.4 billion. This is reflected in many physical retailers pivoting to a digital strategy.

2019 was a big year for France as it crossed an important milestone: ecommerce sales of both products and services passed €100 billion to reach €103.4 billion. This is reflected in many physical retailers pivoting to a digital strategy.

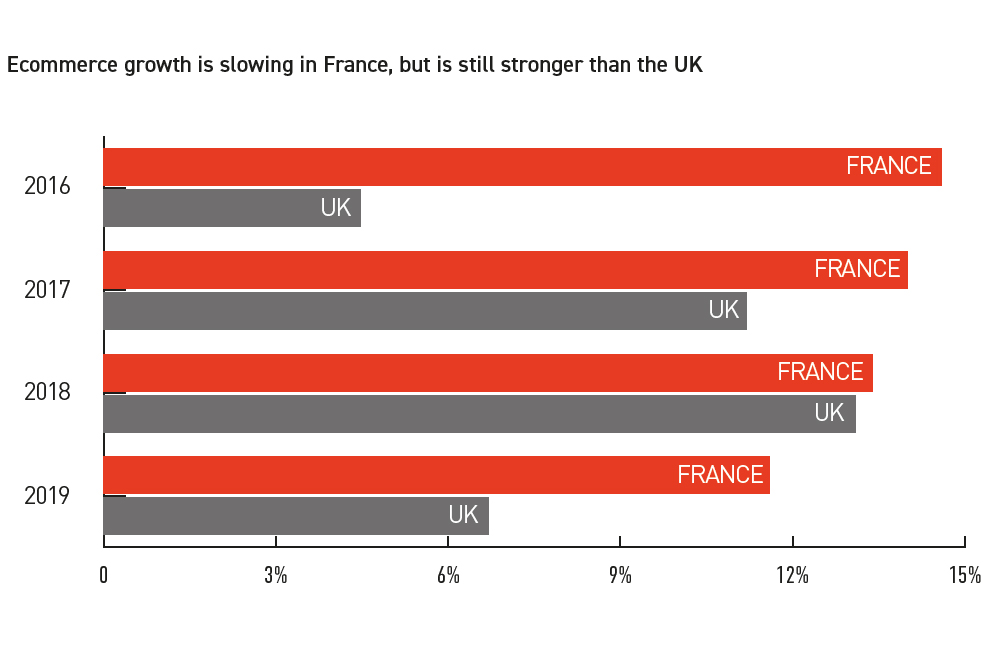

The data from official French ecommerce association Fevad found that online turnover had risen 11.6% year-on-year and fourfold over the last ten years. The online market is still immature compared to the UK, with product sales online representing around 10% of total

retail sales, with the rest made in store. The UK figure oscillates but at several times in the last 12 months has gone over 20%, according to ONS figures.

It is likely the proportion of sales (if not necessarily the absolute volume) taking place online in France will grow this year due to government measures to prevent coronavirus, involving the shutdown of physical stores and citizens being confined to their homes.

The number of retail sites has grown 15% in a year to 190,000 listed merchant sites, with the majority of these sites carrying out less than 100 transactions per month.

This growth came as the average basket size continued to fall to below €60 in the year, a decline which Fevad said had started in 2012, as consumers pivoted to smaller, more frequent transactions. Consumers make 3.5 transactions per month making up a €2577 spending over the year.

This fall was offset by a considerable increase in the number of transactions, with over 1.7 billion orders registered. This figure was up 15.7% year-on-year.

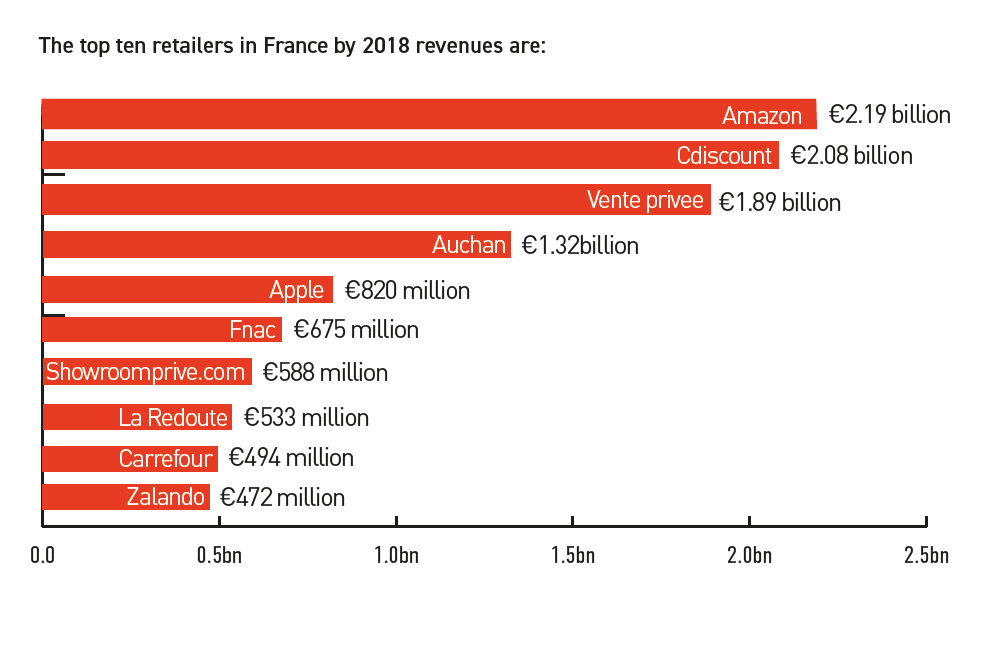

Within these figures, Fevad found that sales via marketplaces had risen 14% year-on-year, with a third of business volume on these sites carried out by third-party merchants.

Within these figures, Fevad found that sales via marketplaces had risen 14% year-on-year, with a third of business volume on these sites carried out by third-party merchants.

In predictions made before the extent of the coronavirus pandemic became apparent, Fevad said ecommerce sites should achieve similar growth in 2020, reaching a turnover of €115 billion and nearly 2 billion transactions. However, in an update posted at the end of March, Fevad indicated that while 94% of ecommerce sites are still open, 76% had recorded a decline in sales since 15 March.

According to the Ecommerce Foundation, fashion will be both the largest and the fastest growing sector between 2020 and 2021. Its share of the ecommerce market will be 15% in 2020, rising to 18% in 2021.

The second largest sector is food & personal care, set to rise from 11% to 12% in the same period. Meanwhile, toys, hobby & DIY will rise from 10% to 11% while electronics and media will rise from 8% to 9%.

To learn more sign up for our ‘What you need to know about selling in France’ Webinar to be held at the end of this series on the 1st of October. Register here.