If you are despatching items destined for the EU at the Post Office, you should be aware that any parcel containing gifts or goods must now have customs form attached to it.

The UK’s exit from the Customs Union means that customs declarations which apply to non-EU countries has been extended to EU counties. A form does not have to be completed if you are sending a letter, postcard or document to an EU country.

Around 45% of the total international parcel traffic received by Post Offices in Great Britain goes to EU destinations. The Post Office is advising customers that they can pick up customs forms at its branches and complete them at home before returning to their Post Office to hand over their parcels in order to save themselves time. Forms are also available for download.

Who needs to complete a Customs form?

Required: England, Scotland, Wales

The new requirement applies to anyone posting a parcel from England, Scotland or Wales to EU destinations. This was already a requirement when posting a parcel to non-EU destinations.

Not Required: Northern Ireland

Customers posting a parcel from Northern Ireland to EU destinations are not required to attach a customs declaration form. However, they must continue to do so for parcels going to non-EU destinations.

Which customs form do you need?

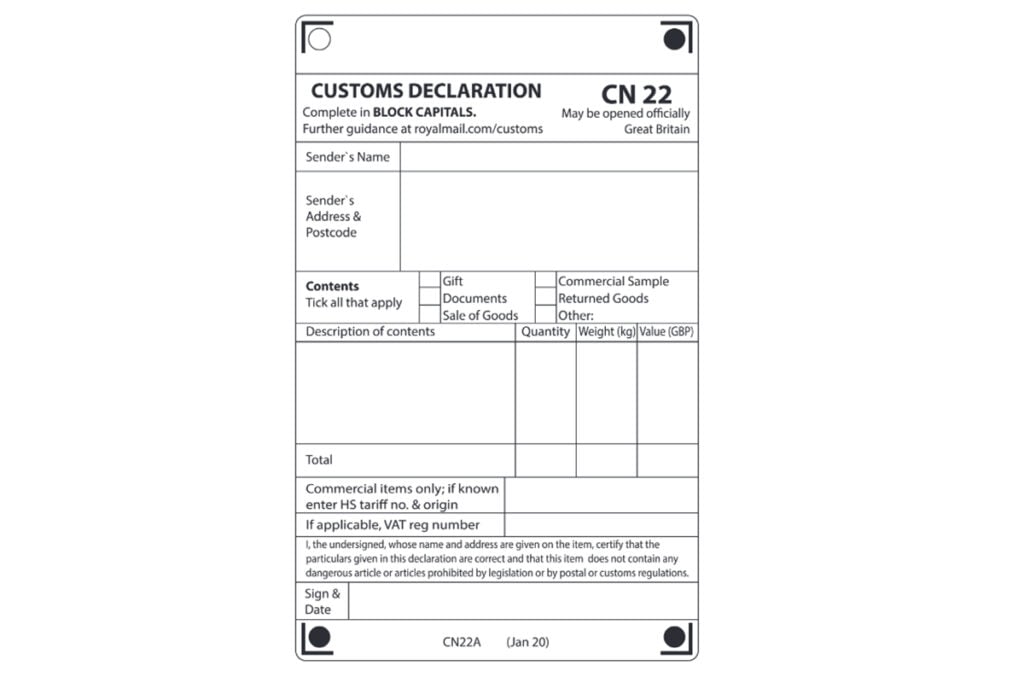

Note that the sender is legally responsible for the information on the customs declaration, so it’s important to ensure that it is accurate and complete. This means for example, specifying ‘Ladies leather jacket’, not just ‘Jacket’.

Items sent via Royal Mail

For items worth up to £270, make sure you include a completed and signed CN22 customs label.

If you are sending your item by Royal mail International Standard or Economy, your Post Office branch can give you the appropriate (barcoded) CN22 label.

For items worth over £270, complete and sign a CN23 form. You can ask staff for help with this in your local Post Office branch.

Items sent with Parcelforce

Irrespective of value, items will require a customs declaration form which you can pick up in-branch. Any items sent with Parcelforce globalexpress will require the customs declaration form CP72 regardless of the destination.

“We know that over the past few weeks, many people will have been preoccupied with thoughts about Christmas and the pandemic. Postmasters are on hand to provide practical advice, particularly to small businesses, who regularly send parcels to the EU. Customers should also look out for a leaflet in branches that has information about the new customs declaration requirement.”

– Amanda Jones, Retail and Franchise Network Director, Post Office

8 Responses

So we can only use the CN22 above if using a tracked service?

So we can only use the above on tracked items?

What about sending a parcel from England ,Scotland or Wales to Northern Ireland?

Is a CN22 form required or not.

Perhaps you should illustrate the article with the CN22 being produced by Click & Drop which whilst basically the same has spaces for EORI and VAT details. Whilst mentioning EORI perhaps some clarification on whose EORI should be used if I sell on eBay. Is it mine or is it eBay’s as the VAT payer?

WOW NI is getting different treatment from the rest of the UK. I swear Boris keeps giving more and more excuses for Sturgeon to kick off. So much for the integrity of the UK single market which they bleated on for long enough. Probably good for NI however.

Can see fulfillment hubs springing up in the North, it is a time must have now thing. Now that we all have to clear customs it will put customers off. Some countries will be more better than others, can see the French being slow they have a habit of that.

That UK trader scheme seems a bit of a farce too, 4 months the said to me to complete the application.

CN22 not needed for the NI from the U.K. for the first 6 months.

Franking machine users (like me) must also attach a S10 barcode to all untracked packets.

Stephen,

You don’t need a CN22 for UK to NI via Royal Mail

Royal Mail sent an email about this to business customers on 31/12/20 to say that (long story short) following government guidance and with a few exceptions for some business customers, everything will be the same as usual for now.

Do I need to put an EORI number on my customs sticker if I send an item of clothing to the eu using a signed for service, posted at the post office (and under £50 total price). I am a sole trader.

Also, do I need to pay a tariff of 12% on any item of clothing sold to the eu? (do tariff’s apply to individual sales from a sole trader to a customer in the EU).