Online sales of high-tech home appliances and gadgets are slowing down according to Foxintelligence. After 2 record years during the health crisis, sales are stabilising and the market is rebalancing.

Now that everyone has bought a robot vacuum cleaner and a fancy coffee machine, priorities are shifting elsewhere – and sales are dropping. However one product appears to be immune to the high-tech slowdown and that is Air Fryers where sales remain resilient and, as recently reported by Monsoon, top the list of favourite wedding gifts in the UK.

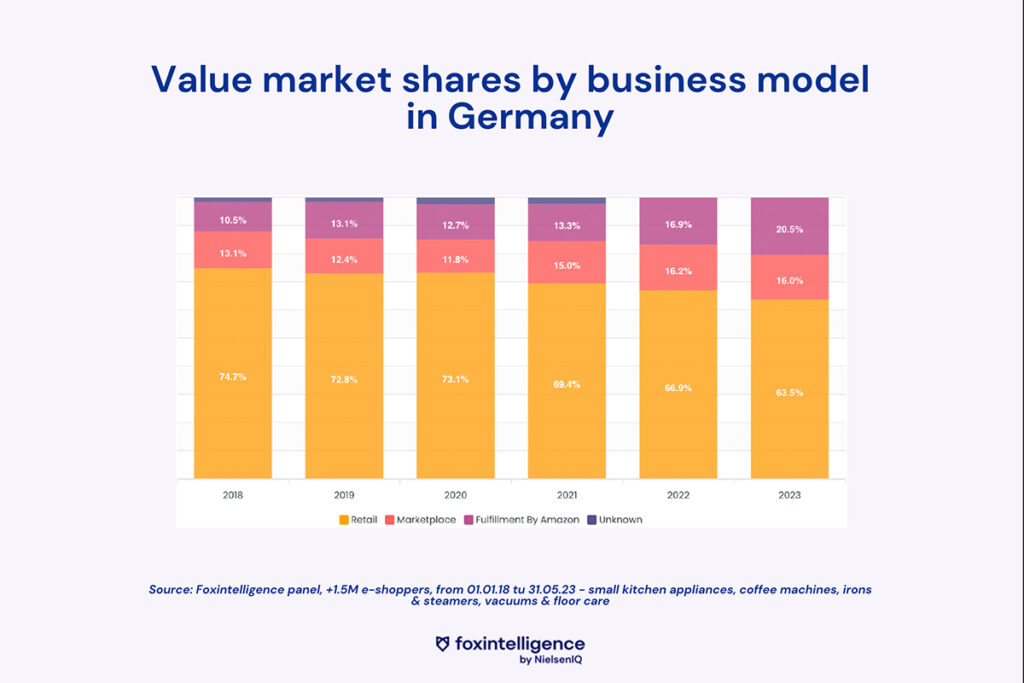

In the high-tech market, the weight of retail is steadily declining. It still accounts for over half of total sales, but it fell by 10% in multiple categories between 2020 and 2023: small kitchen appliances, coffee machines, irons & steamers, vacuum & floor care. This decline has benefited marketplaces and Amazon FBA which are gaining market share year after year (see image above).

Marketplaces have also become a gateway for emerging brands. Brands are starting to sell their products on marketplaces without distribution contracts or commitment. It’s a way of testing out their products and business models, and quickly understanding whether their product is finding an audience. They can then move on to other channels when their market share meets their expectations.

Insights: Roborock & Dyson

In Germany, Roborock entered the market via 3P (Amazon marketplace selling with FBA). In 4 years, the brand has multiplied its online market share by 4 in the vacuum cleaner segment – capturing 16% of the category’s online market share by 2022.

Taking a look at the brand’s distribution mix, it can be seen that the marketplace and fullfillment by Amazon approach has enabled the brand to establish itself on the German market without a large-scale distribution agreement. This strategy is rooted in caution, but has proved highly effective. Comparing retail-only and retail + 3P data, it’s clear that Roborock has taken advantage of the 3P strategy to grow in the German market – especially in the early years.

In Germany, only MediaMarkt/Saturn compete with Amazon in online sales of Roborock products for example. The group began selling Roborock as a 1st-Party (1P) in 2019. By 2022, it was capturing over 35% of its online sales.

Again in Germany, almost half of Dyson’s vacuum cleaner online sales (by value) are DtoC.

Foxintelligence point out that high-tech market players need to monitor their online market and the behaviour of their competitors and consumers in real time: to gain market share and stay one step ahead. Brands that perform well through 3P often end up making their mark in retail: it’s important to monitor sales across all channels, not just retail, and to analyse trends to capture emerging players (brands and sellers)