Figuring out how to tax digital assets and how to handle VAT when an NFT (Non-Fungible Token) is sold is still being pondered by governments around the world, but Italy could become the first nation to exempt NFT from VAT. David Lingerfelt, Senior Director, Indirect Tax at Avalara, takes a look at what businesses need to know:

Over the last two years, the global economy has seen a steady rise in NFTs. As NFTs proliferate – from virtual fashion and digital artwork to political discourse – it’s clear NFTs are here to stay.

What’s more, Gartner predicts that by 2026, 25% of people will spend at least one hour a day in the metaverse – whether for work, e-commerce, or entertainment purposes. NFTs and digital currencies will play a seismic role in the growth of the virtual economy.

While NFTs are currently a global phenomenon, they are a particularly hot topic in Italy as politicians weigh whether to apply or exempt NFTs from VAT. On June 15, 2023, the Italian Revenue Agency issued draft guidance exempting NFTs classed as original digital artwork from VAT. If legislation is passed adopting the draft guidance, Italy will become the first country to legislatively exempt NFT artwork from VAT.

As the crypto market for art expands, it’s easy to see why Italy would want to be a major player in this industry. Passing legislation to adopt this draft guidance would enable artists to reduce the costs of doing business and save art collectors a significant amount of money. The benefits to artists and collectors could put Italy on a path to accruing a significant share of the global art market.

However, it’s important to be aware that while artists and collectors benefit from this pending legislation, they still have tax obligations. For businesses looking to buy and sell NFT artwork – or who are simply interested in this rising trend – I’ve outlined guidance on how to remain tax compliant in this relatively new market.

Not all NFT art will be exempt from Italian VAT.

It’s easy to get side-tracked by the benefits of exempting NFT artwork from Italian VAT. For instance, assume an artist sells original NFT art for €4,560. The artist would collect €465 in VAT on top of that price. However, if the exemption law is passed, the purchaser does not have the pay the VAT, and the artist does not need to incur the VAT registration and filing compliance expenses.

That said, it’s not all that simple. It’s important to note that the proposed Italian VAT exemption for NFT artwork is very specific and doesn’t apply to all art transactions.

The exemption would only apply to NFTs that include the transfer of an original digital work of art and associated ownership rights sold by the original artist. Middle merchants and second-hand exchanges of digital artwork are still subject to Italy’s VAT requirements. NFTs that include the transfer of ownership or rights to economically benefit from tangible artwork are also subject to Italian VAT.

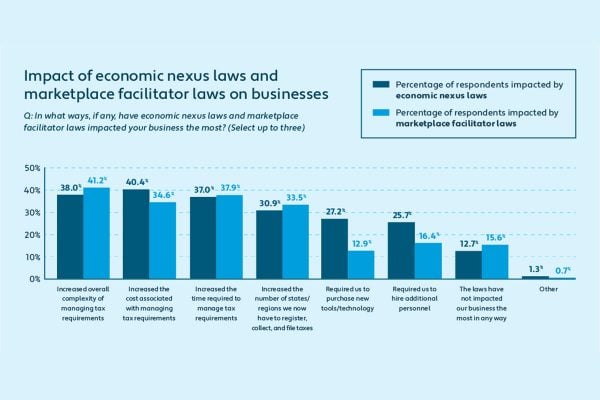

Businesses are faced with evolving requirements.

Looking more broadly at the continent, the EU VAT committee has been asked to review NFTs, including crypto-art. The committee has not issued final guidance. Thus, there remains uncertainty within the EU Commission and other member states on the application of VAT to NFT transactions.

To illustrate, the Danish Tax Agency issued a binding tax answer on June 20, 2023. The Agency ruled that digital tattoo NFT artwork sold by the original artist was exempt from VAT. In recognition of the ongoing NFT regulatory tax developments within the EU, the binding tax answer from the Danish Tax Agency expires on June 20, 2025.

As proof of the evolving and disparate regulatory developments, let’s explore the differences between Denmark’s approach and Italy’s approach to exempting NFT artwork. Denmark issued a binding tax answer that is fact-specific and time-bound. Denmark’s ruling is based on the sale of digital NFT artwork by the original artist without the transfer of the copyright. Thus, the Denmark Revenue Agency ruled the sale was exempt from VAT under Denmark’s artistic activity exemption.

Italy issued a draft regulation that requires enabling legislation to become effective. Italy’s approach is legislatively driven rather than taxpayer specific. Instead, Italy proposes that original digital NFT artwork is exempt from VAT under an exclusion of services that involve “assignments, grants, licenses, and the like relating to copyright by authors.” Though both countries reached the same result, the approach and scope are significantly different.

Exempting digital NFT artwork from VAT can be an exciting prospect for many businesses – particularly startups and entrepreneurs in the NFT market. It offers costs saving benefits against the backdrop of ongoing business recovery and historic inflation levels. However, it requires businesses to prioritize tax compliance by effectively navigating both existing and emerging regulatory requirements and paying attention to the broader crypto market. As an example, exempting digital artwork NFTs from VAT could attract foreign investment in Italy’s art market. This could lead to more blockchain and cryptocurrency regulations to stem elicit transactions, which will have an impact on businesses operating in the crypto economy.

Government guidance to businesses on how to stay tax compliant whilst tapping into the NFT market is lacking. There is either no relevant guidance or the guidance is in draft or otherwise narrow in its application. It is more important than ever that businesses purchasing and selling NFTs remain vigilant in monitoring the evolving guidance on NFTs and VAT. Businesses operating in crypto marketplaces must also monitor broader crypto regulation to ensure they remain compliant with securities, money laundering, and tax reporting regulatory developments.