Hardly a day goes by without a news story covering the credit crunch, but what difference will it make for sellers on eBay?

Hardly a day goes by without a news story covering the credit crunch, but what difference will it make for sellers on eBay?

Buyers

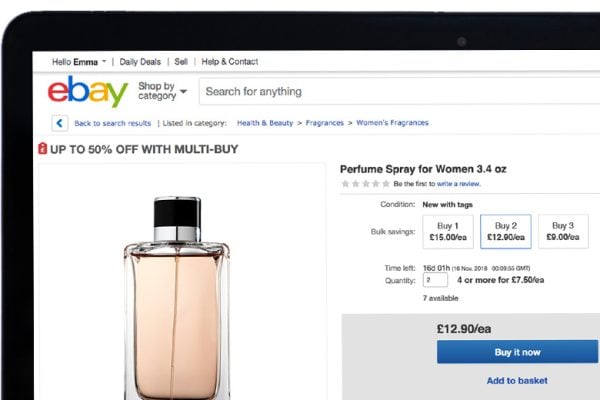

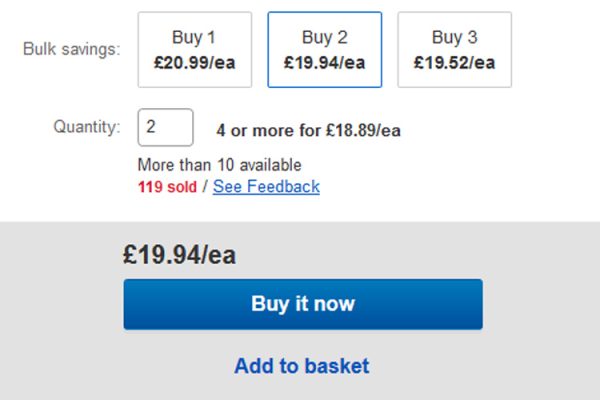

Buyers are likely to hold off purchases of luxury goods, but that doesn’t mean they won’t be spending. There will still be birthdays, anniversaries, people will still move house but more than ever buyers will be looking for great deals. Buyers can save money by shopping on eBay – buying second hand instead of new, shopping on eBay.com instead of eBay UK to take advantage of the weak dollar, buying last seasons model rather than the latest version. Buyers looking for bargains should be great news for eBay sellers.

Stock Profiles

Sellers should take a look at their stock profiles and only order in goods that are needed. Save your money for products which you know will sell and if you have stock of slow moving items consider listing them at bargain prices. Money tied up in stock isn’t working for you and even if you make a loss on stock which has sat on the shelf for a year you can reinvest in lines which will make a profit and sell faster allowing you to buy yet more stock. The faster you turn your stock into sales the harder you can make your money work.

Credit Lines

Don’t be surprised if your suppliers tighten up on credit limits and payment terms. They too will be looking at their financials and will want to collect debts as quickly as possible so that they can reinvest in new stock. Consider asking for a cash discount for advance payment even if you have 30 day credit terms.

Banks

You’ll find it harder to get loans and credit card companies may review credit limits. Banks may review overdraft limits so if you use these to fund your business make sure you can survive if your own credit is restricted. Cash flow and an available balance to meet debts on time is key.

Bankruptcy

Sadly not all businesses will survive, but for those that do there are rich pickings to be had from bankrupt or liquidation stock. Look out for bargains and keep an eye on what’s happening with competitors in your marketplace. As a seller of computer products I already have my eye out for Lehman Brothers to start selling off their London office IT infrastructure.

Cut Costs

Now is a great time to assess the costs you incur in your business. What costs can be trimmed and do you have unnecessary luxuries that could be cut? Look at bulk buying essentials such as packaging material if it can save you money but at the same time don’t over order on items you can do without. Economise were you can, for instance using a mono laser for printing invoices rather colour printers, that alone can save £100s on ink over the course of a year.

Cut a deal

As businesses prepare to tighten their belts it’s an excellent time to look for new suppliers. Negotiate your terms remembering that for a good deal both parties need to win. Suppliers will still have sales targets to meet so a large order with cash on delivery may net you extra discounts.

I firmly believe that recession is always a great time for small traders to make their mark. Larger companies with big overheads are less able to trim costs and switch product portfolios. Although tough trading times may be coming, if they prepare, eBay sellers should be well placed to take advantage.

If you’ve got any more tips for trading through the credit crunch add them in comments below

10 Responses

ho hum spose it will haf ta be a Merc rather than an Aston this year

Do not get dragged down by the negativity in the media…

we have sold £45,000 in the last 3 months on ebay.

with one id alone

how many more platinum powersellers and above do ebay have doing the same

there is still lots of money out there

its the banks with their face stuck too far in the swill, that is the problem

A recession could be good news for online sellers, its the Bricks & Mortar businesses that will sufer most. Today Rosebys and Motorworld have gone into administration, MFI holding crisis talks and JJB shares half, see https://www.manchestereveningnews.co.uk/news/business/

MFI holding crisis talks?

A cabinet meeting per chance?

#5 lol.

Good & sound advice Chris.

Sometimes the little things, when added up, can make a difference.

We looked at the nuts n bolts of our operation and made savings in stationery & packaging costs.

Also, just changing the way you do things can save time which, as we all know, is money.

The credit crunch mainly means many people will forego expensive vacations and socialising. In other words they will tend to stay at home more – where perchance they stumble on eBay – and then attempt to sell some old useless stuff to raise much needed cash – to meet their mounting debts caused be the cruel credit crunch.

But we all know how new eSellers quickly become new eBuyers as the addictive nature of eBay starts to take hold. This means a wider customer base perhaps even on a worldwide scale if the crunch settles in for a long duration.

We eBay our stuff from the distant island of Koh Samui in Thailand, a third-world country where living is cheap and where picking up cheap local stuff is easy – and we then export it at a fair profit to any eBuyer in the world. Buy cheap sell cheap – it all adds up in the end.

Bring on the crunch I say!

Thanks for the sound advice Chris. I think you’re absolutely right. As eBay sellers we should gear ourselves up for the inevitable upturn for us (fingers crossed!)

I think that the credit crunch is being massively overplayed by the media. Although it’s true that food and energy costs have rocketed, so far I haven’t noticed any great difficulty getting credit.

Watch out for price rises from suppliers, the £ is at $1.67, 20% down.

On the plus side might knock a few Chinese sellers off Ebay UK