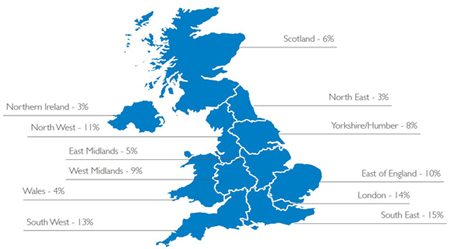

Last week, the banks reluctantly released a geographic breakdown of small business lending. The take out is that despite the Government ploughing billions into banks and launching countless initiatives to boost lending, bank lending to small business has dropped in a staggering 98 of 120 (82%) of the UK’s postcode areas.

iwoca took this as an opportunity to look at their lending by postcode, and they spotted a rather interesting trend. Christoph, CEO of iwoca told me that when they checked the books it turns out that iwoca increased their lending to SMEs in nearly all (98%) of the postcodes where bank lending has fallen. In fact the majority of their customers are now concentrated in those areas.

iwoca took this as an opportunity to look at their lending by postcode, and they spotted a rather interesting trend. Christoph, CEO of iwoca told me that when they checked the books it turns out that iwoca increased their lending to SMEs in nearly all (98%) of the postcodes where bank lending has fallen. In fact the majority of their customers are now concentrated in those areas.

It just goes to show once again that there’s a clear demand for finance. What’s interesting is that iwoca are lending more in the areas of the country that the banks are lending the least. The demand is there. We, the tax payers, own hefty shares of a few banks which the government are managing on our behalf and yet we still can’t get them to support small businesses.

You have to start to wonder if the banks have a clue what they’re doing. No one would argue in favour of irresponsible lending, but in the old days you’d have popped in to see your bank manager, told him how your business was doing and he’d have made an individual decision on a loan. These day’s it’s all down to what the computer thinks of your credit score, and that’s where companies like iwoca differ. They’re doing the job of the bank manager, assessing your business as a business not as a credit score and making individual decisions, albeit with the backup of some smart technology.

What the banks aren’t doing, but what iwoca do do is look at more than just the balance in your bank account. iwoca connect to numerous sources including a new integration with FreeAgent online accounting. (Incidentally to To celebrate iwoca are offering the first month interest free to new customers who sign-up with both a FreeAgent and trading account).

Will the banks ever catch up and start lending to small businesses and especially learn how marketplace retailers operate? Hopefully one day, but in the meantime there is some good news – the banks have made way for entrepreneurs like Christoph to take up the slack.

Will the banks ever catch up and start lending to small businesses and especially learn how marketplace retailers operate? Hopefully one day, but in the meantime there is some good news – the banks have made way for entrepreneurs like Christoph to take up the slack.

If companies like iwoca continue to flourish perhaps when the banks decide they want to lend again small businesses will be so used to alternative finance that they will no longer bother with traditional loans.

4 Responses

I think credit scoring should be made illegal.

Not only do all the banks and finance companies force us to let them share our confidential financial info, it actually forces an impersonalised and largely mindless level of bad service upon us all.

Let’s ban this destructive practice.

I’m curious though. You mention that the banks won’t lend to these people but Iwoca do and the banks need to catch up. But how successful are Iwoca? Just because you are lending to people the banks won’t and helping them doesn’t mean your own balance sheet is black. Have they ever publicly mentioned their earnings?