If you frequent newsagents at many major railway stations, you may have come across a store where you can pick up a newspaper, drop the cash into a payment box and simply walk out of the shop without having to queue at the checkout. It’s a convenience and the store accepts the risk that you might not pay and, judging by the fact they still do it, most customers must be honest.

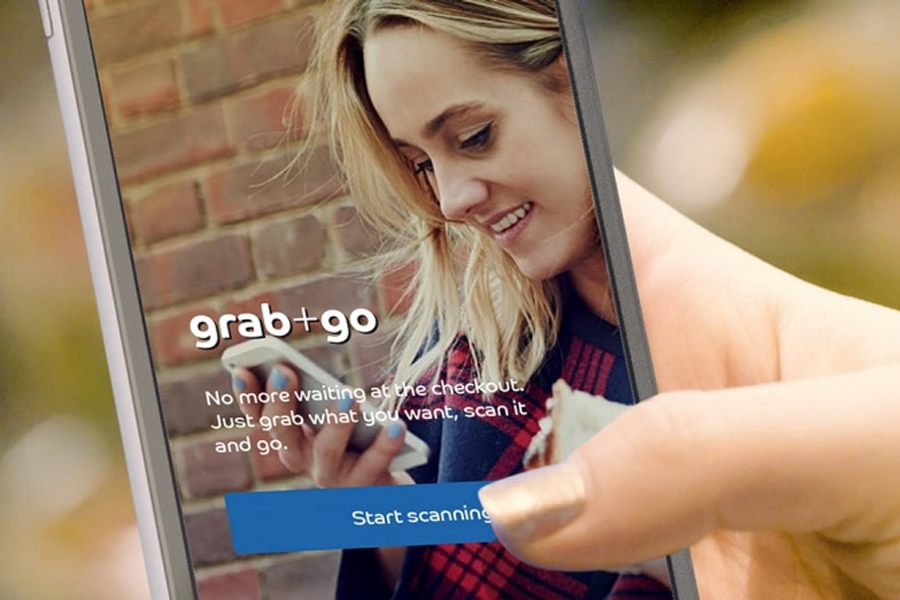

Now Barclaycard wants to take this one step further with a new ‘Grab+Go’ mobile app that allows you to scan your own shopping, complete your purchase with a single click and walk out of the store. Grab+Go transforms a smartphone into a ‘pocket checkout’ and is currently being trialled in Barclays’ staff restaurants in the UK and the US to garner feedback before public roll out.

Users download the Grab+Go app, create an account and pre-load their payment details, and then use their smartphone camera to scan the barcode on items as they go. When finished, they click ‘I’m done’ and walk out; payment is taken seamlessly and invisibly in the background and the receipt is stored in the app. Obviously there would be a digital receipt so that you can prove you’ve paid for the items in your bag should the need arise.

The concept is not that different to self scanning in supermarkets, although normally then you still have to go to a checkout with your barcode reader to complete payment. The type of purchase that Grab+Go would be ideal for would be a meal deal of sandwich, drink and crips for your lunch – fairly low value and speed is of the essence.

“One of the key customer frustrations with shopping is the time spent queuing to pay for items they want to buy – especially when they are in a hurry. Using the latest technology, we’ve developed Grab+Go to streamline the shopping experience by removing the need to physically check out every time you want to buy something. The way in which people shop and pay has evolved significantly over the past decade, and as the use of mobile and wearable payments grows, we are constantly looking at how we can use technology to make our customers’ lives easier.”

– Usman Sheikh, Director of Design & Experimentation at Barclaycard

What’s really interesting about this trial would be if similar technology was built into mobile apps for popular online payment methods – I’m thinking PayPal, Amazon Payments, Square etc. Amazon are already experimenting with their Amazon Go stores, but that relies on a store where every product is monitored as it’s removed from the shelf – not something your local WHSmith could install.

Online payment solutions already have our payment details stored, so if the Barclaycard trials prove successful don’t be surprised if they rush out a competitive offering – PayPal et al might have the lions share of our online spend but they all want to cut a slice of the offline pie too. It’s not just about the processing fees either, although these are what keep the shareholders happy, it’s about tying consumers into the brand because if you pay offline with PayPal you’re almost certainly likely to prefer to pay with them online too.