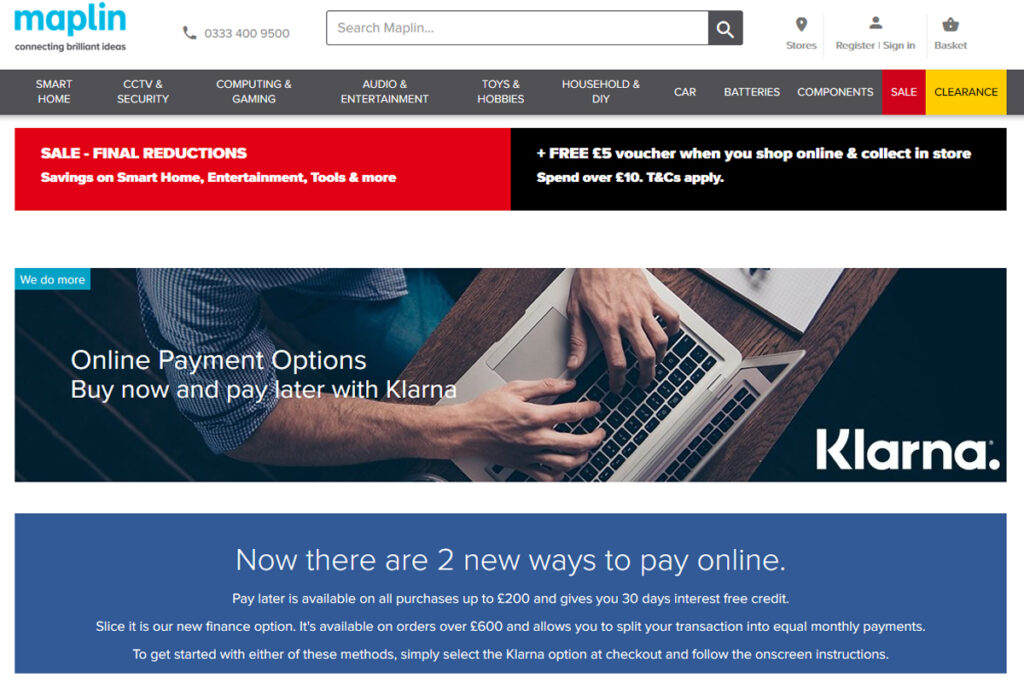

Maplin’s have added new payment options enabling customers to use Klarna ‘Pay later’ and ‘Slice It’ services. Maplins customers will now be offered a range of payment options simply by providing their mobile phone number and email address with the ability to pay after delivery.

“Making sure our customers have the best possible user experience is of the utmost importance to us. With more people than ever shopping online, the payment flexibility provided by Klarna’s solutions is a real added benefit for our shoppers.”

– Alexander Allen, Services Director at Maplin

Maplin is one of the first retailers to adopt Klarna’s unique payment options to help their customers access not only physical products, but also services – such as security installation and maintenance.

Klarna’s uniqueness is their ability to streamline the checkout to pretty much nothing more than providing an email address with customers given the options to pay immediately, pay later or split payments over several months for larger purchases. Partnering with Maplin gives Klarna exposure to consumers with a major UK high street retailer with 218 stores.

Klarna payment options

“Customers today expect a variety of convenient payment options at the checkout. We’re happy to be able to give Maplin customers greater control over how and when they pay for their purchases – which is especially important to savvy electronics shoppers making higher-value purchases.”

– Luke Griffiths, Klarna’s UK General Manager

Klarna Pay Later

Pay later enables online and mobile Maplin customers making purchases of £200 or less to receive their products and pay for them 30 days later, with no interest or fees. They can touch, feel and see their chosen items to ensure they’re happy with them before parting with their money.

Klarna Slice It

Alternatively, Maplin customers can choose Slice it at the checkout, which allows shoppers to spread the cost of purchases of £600 over equal monthly payments. Klarna’s consumer finance is significantly simpler than that of other providers – with only a 4-step application and real-time decisioning.