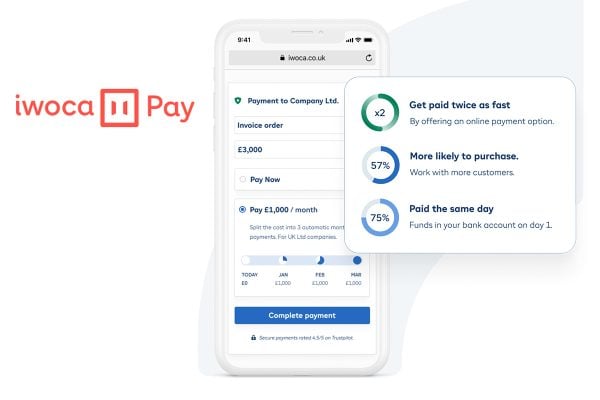

If you’re based in the North and struggling to access finance, then iwoca, the small business finance company that started out to offer loans to marketplace sellers before expanding to support both online and offline businesses, have pledged to make £100 million available in small business loans.

iwoca is making the pledge in response to the withdrawal of credit facilities for small businesses by the UK’s banks, which has been most acute in the North.

“Micro businesses are the powerhouse of the UK’s economy. Even though they employ less than 10 people, they account for 96% of the UK’s 5.5 million businesses, one-in-three private sector jobs and 20% of all economic output. The banks claim that small businesses are simply not interested in credit products. In reality, the banks discourage these businesses from taking finance through lengthy and cumbersome application forms, and rigid and unfair lending criteria. iwoca understands the needs of small businesses. That’s why our applications are simple and straightforward, and we have built technology to make faster and fairer lending decisions, breaking the barriers small businesses face to accessing finance.”

– Christoph Rieche, Co-founder and CEO of iwoca

According to data collected by UK Finance, the value of lending (loans and overdrafts) for Small and Medium Enterprises in the North of England has contracted by 14.3%, compared with the national average of 9.5%, over the past three years. The North West is the worst affected region, suffering a contraction of 15.3% in three years.

In Manchester the contraction has been even more dramatic, declining 22.8% over the period, which is twice the contraction experienced by London at 11.4%, also according to UK Finance. Business confidence in the North West now stands at -17%, in contrast to London at +13%t, according to the FSB’s Voice of Small Business Index.

In contrast, iwoca’s support for small businesses in the North of England has seen its lending grow 89% per year over the past three years. In Manchester it has grown 65% per year over the same three-year period. Of the £100 million pledge that iwoca is announcing, £15 million is for Manchester alone.

One Response

IWOCA is a great company and they actually do follow through with lending capital even if the company or entity has bad credit.

However be careful, IWOCA loan comes at hefty % interest rate

And make sure you don’t get your self-suspended on a marketplace after taking out a loan with them.

I speak of experience and it does hurt