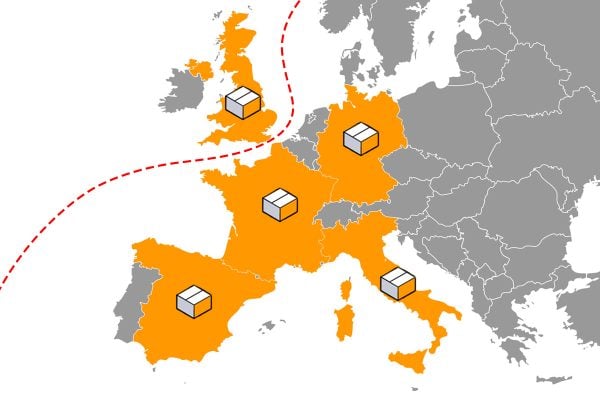

Many merchants and online retailers are importers, bring goods in from the European Union. That could be goods they intended for sale on marketplaces or the materials to use to make or manufacture goods for sale. The new UK Government advice in the event of a ‘no-deal Brexit’ examines what the new arrangements might be if the UK leaves the EU without a deal on 30th March 2019.

You can find the guidance here on the official website. But here are some of the details. Before importing goods from the EU, a business will need to:

- register for an UK Economic Operator Registration and Identification (EORI) number. Businesses do not need to do anything now. There will be further information available later in the year.

- ensure their contracts and International Terms and Conditions of Service (INCOTERMS) reflect that they are now an importer

- consider how they will submit import declarations, including whether to engage a customs broker, freight forwarder or logistics provider (businesses that want to do this themselves will need to acquire the appropriate software and secure the necessary authorisations from HMRC). Engaging a customs broker or acquiring the appropriate software and authorisations form HMRC will come at a cost.

- decide the correct classification and value of their goods and enter this on the customs declaration.

How likely are these rules to come into force?

In this case, it seems more likely that this model of operation will come into force if there is a deal or no deal. After all, the UK government has said that it will be seeking a new relationship that doesn’t permit the free movement of goods and is outside of the customs union. In such a circumstance, import controls from EU member states will be required and these look like a probable model. That said, nothing is agreed yet, negotiations are ongoing and even the UK’s Government’s position seems prone to shift. So we continue to wait and see.

What do you think about these new rules? Will you be impacted? Will you engage a specialist to help you with imports?

And don’t forget that we’ve already looked at some of the other guidance regarding a ‘no-deal Brexit’ in other articles:

One Response

Thanks to all those who thought leaving the EU was a good idea. Which ever way you cut this it will be more time consuming, more costly, less efficient. No wonder the big international employers are considering their positions in the UK.

However, it is a long way to go and I still live in hope that someone somewhere in Westminster will start to show some common sense and admit to the damage this will do to the British economy, and therefore to the job and business prospects of all of us.

Fortunately I expect my last international delivery to be in October, as I prepare to retire, so I can leave it to every one else to “enjoy” the consequences.