Amazon have joined Apple and become the 2nd company to have a $1 Trillion valuation. That’s $1,000,000,000,000.00 or a million million dollars.

This $1 Trillion valuation isn’t based on any real value however. Shares in a company have a perceived value and much of that is based on a company’s potential for growth and future profits. That’s especially so in the case of Amazon as they’ve only in recent years turned a profit and certainly don’t have assets worth a trillion dollars.

Amazon are perceived to be worth a $1 Trillion valuation, and investors are betting that they are, based on their profits acceleration and the new business revenue streams which are yet to come online.

One of Amazon’s most profitable businesses is AWS – Amazon Web Services. Amazon built their own cloud infrastructure to run their retail business and marketplace operations on and then started to rent their server space to third parties. AWS is now one of the largest cloud computing services available but it’s not this service that investors are really betting on. And investors certainly aren’t excited enough to bet a trillion on Amazon as a retailer, even with their expansion into India and advances in groceries both online and through their purchase of Whole Foods.

What’s exciting investors is their nascent advertising business and their logistics infrastructure.

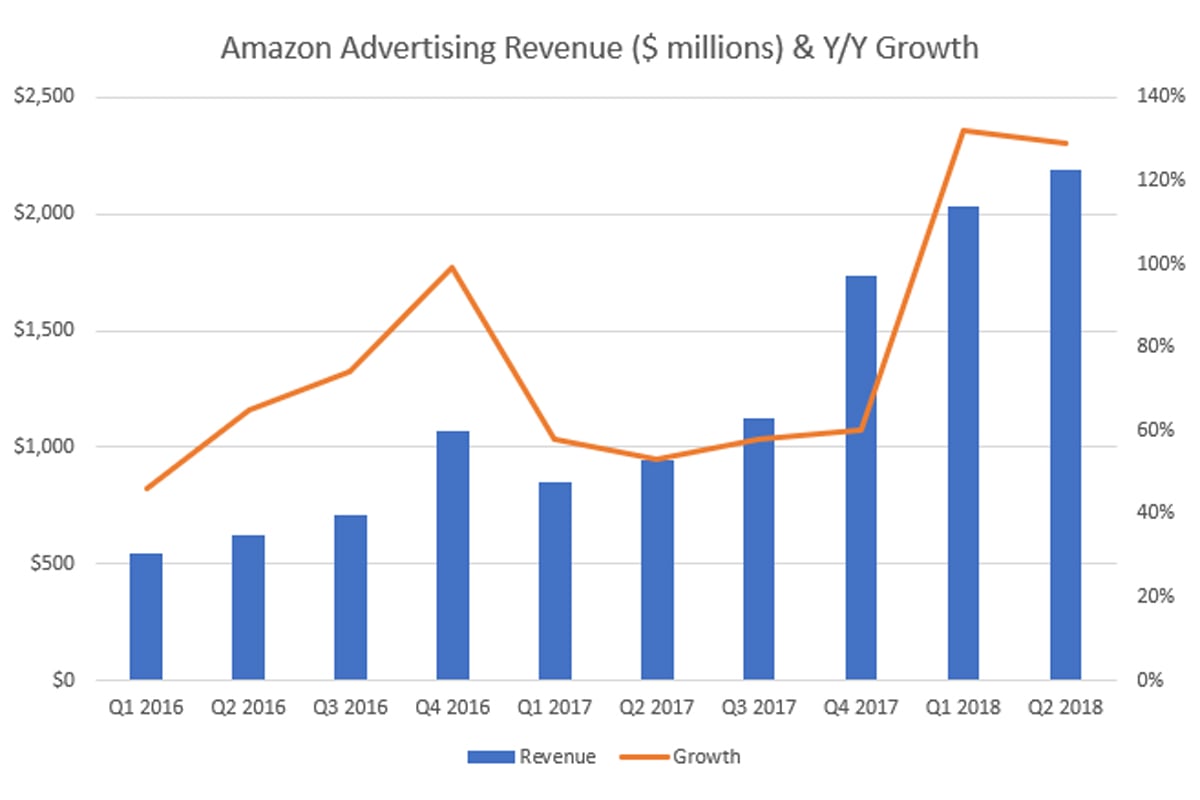

Amazon advertising has come from being non-existent two years ago to turning in over $2 billion profit in the past quarter alone. Advertising, allowing for acceleration in Q3 and Q4, to turn in an annual profit in the region of $10-$12 billion over the course of 2018. They’ve already done $4.225 billion in the first half of the year.

Investors are looking at Google advertising and considering how Amazon’s advertising revenues will accelerate when the company starts selling ads on non-Amazon web properties and considering how this segment of Amazon’s business could see stratospheric growth over the next few years.

Logistics is the second area of interest for investors. They see Amazon investing in Amazon Logistics and expanding rapidly. Amazon is already a dominant courier in the UK with only Royal Mail and Hermes delivering more parcels in 2017. The explosion in Amazon’s logistics business will come when they start to accept parcels for non-Amazon sales. This may seem unlikely, but Amazon have rented out just about every part of their business from retail (marketplace) and servers (AWS), to warehouses (FBA). There’s little doubt that at some point in the future Amazon will start to sell courier services as massive increases in volumes will drive down costs for Amazon themselves enabling ever faster deliveries for Amazon retail and marketplace sales.

Amazon may not be worth their $1 trillion valuation, but investors are betting that in the future they will be.

One Response

I would bet they would be worth the $1 Trillion. Amazon GOT the logistics correct where the rest have failed, that is what got them everything else and the springboard. It is a lot more than just e-commerce.

I bought a lot of RMG shares with the knowledge that e-commerce would just boom. OK I have done alright (it is yo yo share, you sell at the right time and buy in again), but actually it is very disappointing as we wanted to keep the money in long term, am glad Green has gone.

RMG got stuck in the past and never evolved, Amazon (all be it with worker exploitation) GOT it right.

Then you look at eBay 34 Billion they are actually small fry. Imitators not innovators. They are becoming a backwater site now.

Amazon need to sort the tennis out it has been rubbish coverage however.