There is an interesting new marketplace launched in the US which aims to disrupt the banking world called Passfeed. Having seen them raise $200 million, we spoke to Dennis Sary, Marketing Director for Passfeed in the US to find out more.

There is an interesting new marketplace launched in the US which aims to disrupt the banking world called Passfeed. Having seen them raise $200 million, we spoke to Dennis Sary, Marketing Director for Passfeed in the US to find out more.

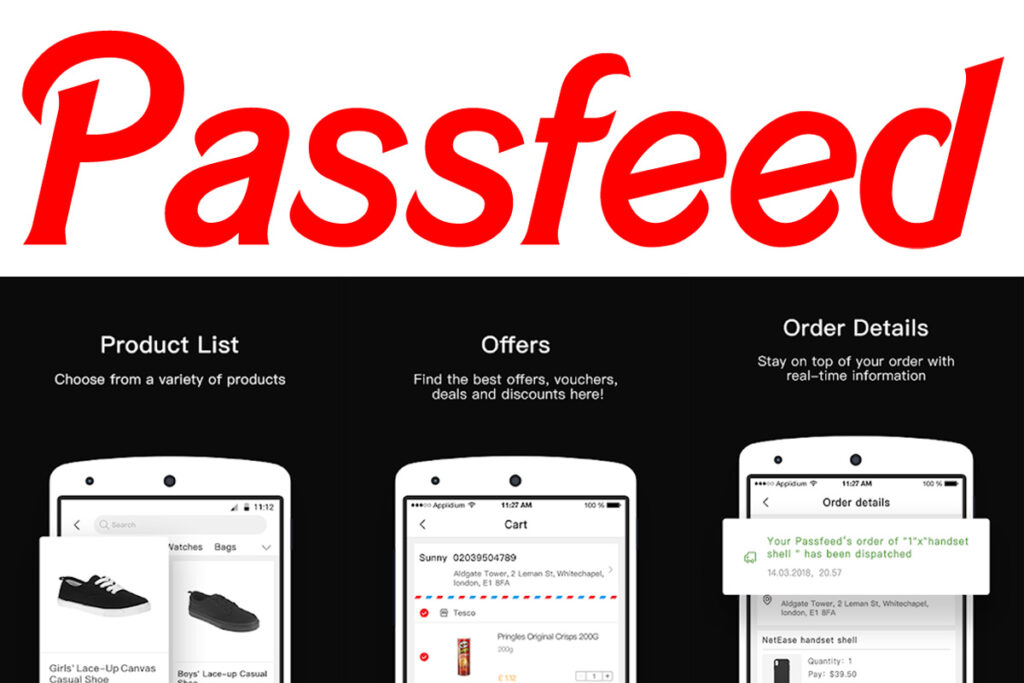

The Passfeed concept is to marry the breadth of inventory available on sites such as AliExpress with the ease of buying that you’d find on Wish with a digital wallet to enable consumers to pay anywhere in the manner of AliPay in China and revolutionise the way that payments work in the west.

Passfeed proof of concept projects around the world

Their journey has taken them on a meandering path starting off with a dating app before they moved into the restaurant business in Thailand and Indonesia which was a proof of concept for the platform.

Whilst the restaurant part of the app is still live in Thailand, their next move was to the UK where they signed an agreement with Barclays to test the banking side of the proposition. Would a major bank sign up to the project and the answer was ‘yes’. They also partnered with Tesco to experiment with groceries and tested gift certificates before turning their attention to the US.

In the US they have focused on the ecommerce side of the proposition and are currently figuring out how to work with banks for issuing virtual debit cards with and figuring out how they can work with banks without becoming an issuer themselves.

Passfeed add ecommerce marketplace to their proposition

Passfeed are using the ecommerce side of their proposition to get people onboard to get them started using a digital wallet before transitioning consumers to using virtual debit cards for future purchases. They’re spending around $2 to $3 million a month on Facebook ads to attract consumers with almost all of the products on offer scraped from AliExpress. Orders, once paid, are passed to AliExpress merchants to fulfil but now Passfeed are ready to start signing US dropshippers.

Within the next month the first US dropshippers will start to be invited to sell on Passfeed and add their inventory before retailers themselves are invited to the platform.

What’s the ultimate goal?

Banking is expensive, both for the banks themselves and the charges they impose on their customers. But Passfeed envision a world where using a digital wallet can empower consumers to bypass traditional banks and use a digital wallet both for ecommerce and for offline purchasing.

One only has to look at some of the most prestigious retailers in London to see that they are already accepting AliPay to cater for the growing trade from Chinese expats and tourists. In China, AliPay is the way you purchase everything from snacks and fast food to transport tickets and even your new car. Similarly in India ICIC have disrupted traditional banking offering an alternative way to pay. That’s what Passfeed want to bring to the West.

Passfeed’s ultimate goal is for consumers to say goodbye to their bank and goodbye to their credit card and embrade a digital wallet for all of their spending needs, but first they need to attract the consumers and that’s where the marketplace and ecommerce side comes in.

If you’re interested in signing up to become a Passfeed marketplace seller you’ll find the application on their website.

You can download the Passfeed app from Google Play or iTunes.

One Response

I used the app before to buy jewelry for my girlfriend!