It’s pretty obvious that many shoppers are frustrated with being locked up for two months and can’t wait to get out and about and indulge in a bit of retail therapy, so shops are likely to see an influx of customers as soon as they open. However there will equally be millions across the country that take one look at the R number, realise that the pandemic is no where near over and all the relaxations in the lock down really means is that there is plenty of NHS ICU capacity, and decide that although the vast majority of those catching Coronavirus experience a mild illness they have no desire to be the one in a hundred or so that end up on a ventilator.

For many, their retail therapy has been online so the question now is not ‘if’ retail has changed forever but ‘how much’ retail has changed forever.

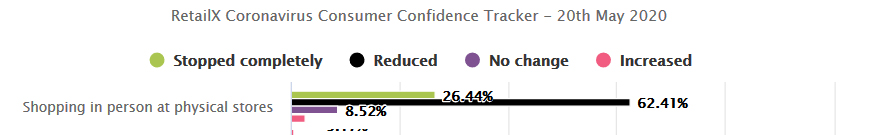

Our sister publication InternetRetailing has been tracking consumer sentiment over the course of the pandemic and latest research reveals that 88.85% of Brits have stopped completely or reduced shopping in physical stores – not surprising seeing as little other than grocery stores have been open for business.

43.9% say that they are likely to carry on shopping as they do now once the coronavirus crisis is over although 48.6% believe they will return to shopping as they did in the past. 7.5% haven’t changed how they shop during the pandemic and it might be reasonable to conclude that if they’ve not changed shopping habits then they probably already do the vast amount of their shopping online. That tots up to 51.4% of shoppers in no hurry for a trip down their local high street.

Retailers will have a tricky path to navigate with the expectation of reduced shoppers coupled with the need for social distancing and the inability to pack their shops on a Saturday morning as they did in the past. Fewer shoppers in town and limited numbers in shops at any one time mean some are already struggling with the maths trying to figure out if their takings will be sufficient to pay their staff, let alone other costs.

It’s also worth considering how supermarkets have coped. In the days before the lock down panic buying was in full swing and immediately after the lock down long queues formed, but today if you wander down to your local supermarket, in many areas of the country, the long queues have vanished and there might be fewer than a dozen people waiting to enter a store when you arrive. After the initial rush to buy, people have calmed down and aren’t quite as keen for a trip to the supermarket and shops may will discover that a first rush for retail therapy is dulled by queuing and the novelty of being able to shop again soon wears off.

This is also unseasonably warm weather as we come into the start of the summer. Shoppers may be more than willing to queue in the sunshine, but it’s likely that as Christmas approaches and the rain, frost, snow and chill breezes arrive that shoppers could be less willing to queue and more likely to give up on the high street and shop online – it’s worth remembering that until a vaccine is available there’s every expectation that we will have to live with coronavirus through the winter. Queuing outside in a biting north wind with ice on the ground won’t be fun for anyone.

Retailers will have to turn to the internet to encourage customers to shop with them more than ever. With stores able to once again open, many will be considering ship from store services and for those willing to brave a trip to the town Where to Buy type services will become more important than ever – if a consumer can confirm a product is in stock they may be that much more willing to make a trip to a physical store.

All of this misery for the high street, however optimistic and keen they are to reopen, adds up to a positive outlook for online retailers. In the past few months many have seen sales at unprecedented levels. As soon as consumers discover their favourite retailers have closed they’ve found new, often smaller, online retailers to serve them. The playing field wasn’t just levelled in terms of the service the high street can offer but crushed with the only option being online and many consumers will have decided they like this new world. The high street must now regroup and move more to online as the one thing that differentiates them – touch, smell, fitting rooms, cafes and coffee, and experiential experiences just won’t be possible the day they reopen for business.

Don’t forget, we are holding a Coronavirus ‘How to get back to work’ webinar on the 18th of June designed to assist everyone who wants to sell online. Coronavirus has had a profound effect not only on consumer purchasing but also on delivery – both in terms of changes in what consumers expect from delivery and the operational changes businesses have had to make to fulfil those services, sign up here to learn more.

Ultimately, the next few months will be interesting for high street retail in more ways than one. But every retailer will be looking at the 51.4% of consumers unlikely to return to their shops any time soon, coupled with the almost 4 in 5 (79.5%) of consumers who believe the pandemic won’t be over within three months and some who don’t think things will ever return to normal. A third of consumers (33.7%) consider it will be one or two years or longer before it’s safe to pick up our normal shopping activity and that’s a long time for retailers to wait until these shoppers return… if they ever do.

One Response

A relation of mine is in charge of hundreds of physical stores in the South and they are convinced they are going to have a boom ( I do not think this will happen).

I know there is a massive shortage of White Goods and things like Laptops in the Country, I have had to order an under counter freezer from a independent in Bristol and it arrived yesterday ( think this thing was made in North Korea never mind China), AO Dixon’s and Argos (who really got of the hook being in Sainsburys stores) could not even supply.

So I think there will be an initial splurge on certain things and a few mad folks will go running into the shops on day one for fake sales but that will calm down pretty quick. Years of Amazon etc playing on a different playing field had killed the high street long before Covid 19.

We are going to have millions unemployed also, still loads on furlough from Holiday industry and Hospitality.

The supermarket I drive for is employing people from industry’s right now who I guess never thought they would be driving a Sprinter Van, and orders just keep coming and coming and they are still huge.

I also see people driving around “well to do areas” delivering Amazon/Hermes parcels in fancy BMWs and uneconomical SUVs this was clearly not there day job beforehand.

They are certainly not downscaling the online delivery either as if we get a second spike in the Winter it will be in even more demand and they of course are making a mint.

This is where the likes of Royal Mail need to get a grip and get ready as online is where it is going to be, even that may get hit as people will have less cash going forward.