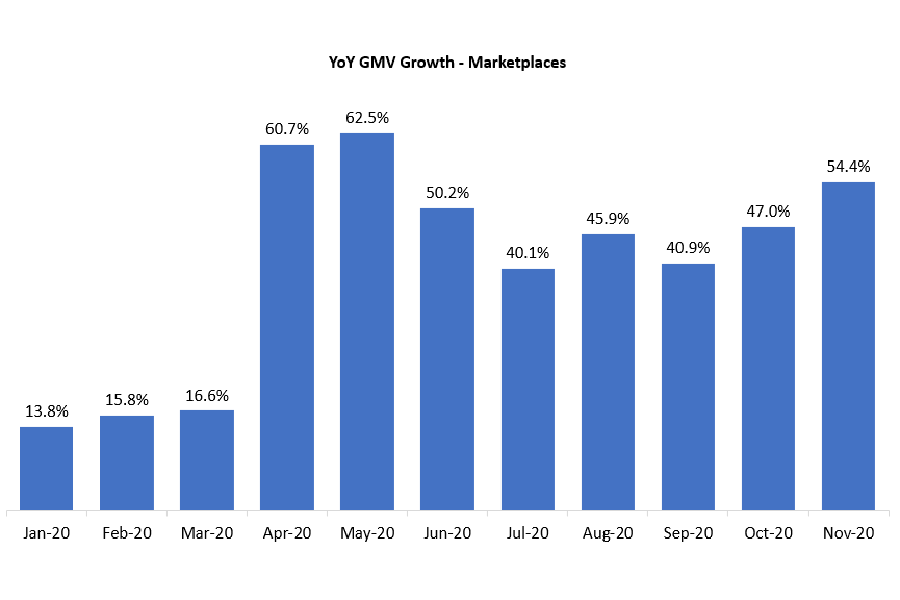

Shopping on platforms such as Amazon and Zalando surged to a six month high in November, rounding out a year of tremendous growth for consumer spend on marketplaces.

The combined effects of extended Black Friday discounting and newly tightened restrictions around bricks and mortar shopping saw the Gross Merchandise Value (GMV) of global marketplaces climb to 54% higher than the same month in 2019, according to worldwide data from ChannelAdvisor. Spend on Marketplaces growth was only higher in April and May, when lockdown restrictions closed stores around the world.

ChannelAdvisor data highlights the enormous Year on Year growth online marketplaces have experienced in 2021 as ecommerce offered consumers and brands a lifeline while the COVID-19 crisis saw shops shuttered around the world. While the beginning of 2020 was still seeing moderate YoY rises on 2019, April saw YoY growth skyrocket to 61% before peaking for the year at 63% in May.

ChannelAdvisor’s data found that success has not been limited to household names such as Amazon and eBay. Marketplaces such as Zalando and Newegg have seen a huge rise in spending on their platforms, some of which have maintained 100% year on year growth from April through November.

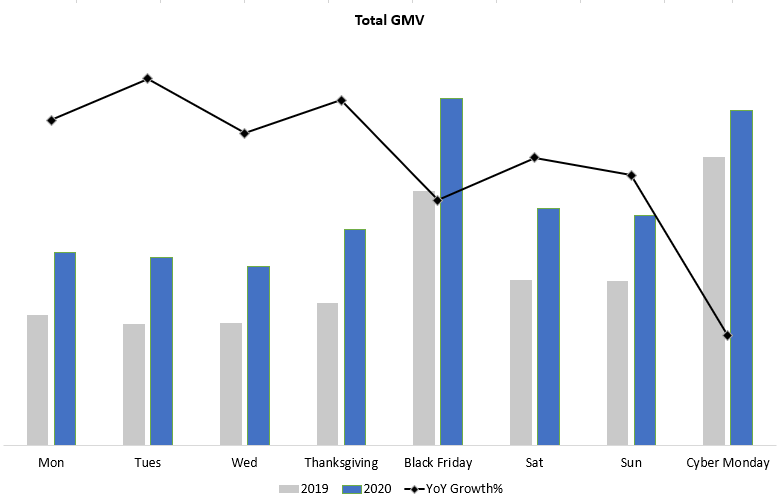

Black Friday becomes Cyber Week

Black Friday and Cyber Monday saw the highest marketplace spending in November. However, closer examination data reveals that the highest levels of YoY GMV growth occurred in the four days preceding Black Friday. This indicates that even more shoppers were purchasing items on marketplaces in the days before Black Friday than they were last year.

“This year has been transformative for ecommerce and an utter triumph for online marketplaces, which have offered brands and consumers alike a valuable avenue for selling and spending. Most importantly we’re seeing consumers shop not just with the best known marketplaces but many emerging platforms too. This should be a wakeup call for brands that settle for selling on just one or two online marketplaces, as it means they’re potentially leaving money which could go straight into the pockets of competing brands.”

– Vladi Shlesman, Managing Director EMEA, ChannelAdvisor