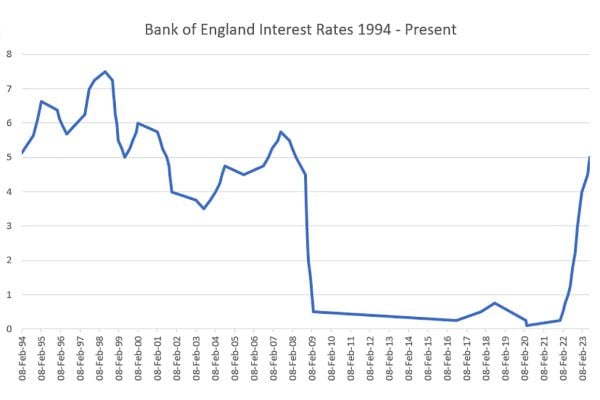

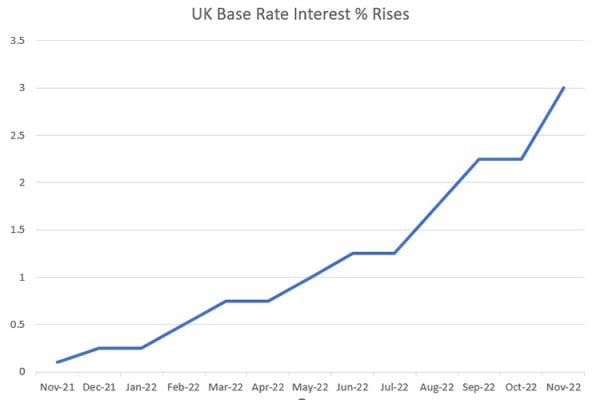

The Bank of England increased interest rates from a historic low of 0.1% to 0.25% this afternoon which will impact about 1/3 of UK adults who have a mortgage. This is the result of inflation which is running at over 5% and could easily hit 6% early next year.

The impact of this is relatively low in financial terms – perhaps £15 a month on the average mortgage, but comes at a time when consumers are already being impacted by record high petrol costs, many households seeing their gas and electric prices soar as their suppliers go bust, and the recent end to the £20 uplift in benefits. £15 a month might not be much for many, but for others it’s a significant hole in their finances.

If you listen to some news sources, you’ll hear that banks have been stress testing mortgage applicants for the past 6 or so years, to ensure that if interest rates rose to 6% or 7% that they’d still be able to meet payments, so 0.25% shouldn’t be a problem. However the reality is that circumstances for many have changed during the pandemic and there’s the inevitable creep of spending rising to available income so spare cash is hard to find, especially when many other bills have risen sharply.

The real question is will the increased Interest Rates make any difference? The reality is that the cost of goods are rising significantly – both the cost of the goods themselves and the transport costs to shift them around the world. We’ve seen the cost of shipping a container from China rise from around $3000 to in the region of $20,000 and that cost has to be apportioned to the goods the container contains. All the time the cost of goods is skyrocketing inflation will continue to rise.

Increased Interest Rates also won’t do much for savers – bank rates on cash are remarkably low and it would take a multiple percentage interest rate rise to make a real difference.

In reality increased interest rates will represent more of an emotional impact to many than a real change to their household finances. But this in itself is concerning as, once Christmas is over, retailers still want consumers spending. The Bank of England might want to temper inflation and it’s hard to argue against their move to raise rates from 0.1 to 0.25%, but consumer confidence is also important and consumers who stop spending won’t help the economy regardless of inflation rates.

One Response

It is more money out of peoples wages packets little by little they are being drained.

The rise effects a property let I have but I am not going to put up the rent but plenty will…it is not a high rise and I will soak it up.

So many do not understand how it works these days also, so many of my friends are mortgaged to the hilt.

Am more concerned about the fuel prices and the gas/electric my fixed rate ends soon.

Everything is shooting up in price your groceries are going up your living costs are shooting up. In a society where everyone wants everything cheap.

In my other job we have lost like 50% of drivers and if it was my only income I would have been off also as the wages are now to be regarded as poor you could not live on it.

The only positive this year (along with google enhanced listings) has been the growth of my own website where I do not have the long lists of fees and add on fees you get with Marketplaces people are finding the better prices and buying more than 50% of last nights sales the wife is processing right now are direct so am delighted with that.

Tough times for many.