With recession forecast for the UK from Q4 and expected to last throughout 2023, retailers may be considering export as a way to bolster their incomes. The news from the International Monetary Fund (IMF) comes with an unprecedented “Gloomy and More Uncertain” title, warning that it’s not just the UK which is impacted, although the UK is bottom of their projections for advanced economies.

Several shocks have hit a world economy already weakened by the pandemic: higher-than-expected inflation worldwide––especially in the United States and major European economies––triggering tighter financial conditions; a worse-than-anticipated slowdown in China, reflecting COVID- 19 outbreaks and lockdowns; and further negative spillovers from the war in Ukraine.

– International Monetary fund

The IMF go on to warn that a plausible alternative scenario in which risks materialise, inflation rises further, and global growth declines to about 2.6 percent and 2.0 percent in 2022 and 2023, respectively, would put growth in the bottom 10% of outcomes since 1970.

Growth in the EU is bottoming out and have suffered from poor growth for a decade, with the ECB pegging Interest Rates to 0% since 2021 and dipping into negative rates since 2014. Growth in Germany, the biggest EU economy has been running at around 2.9% in 2021 but forecast to be 0.8% in 2023 with France not much better with a forecast of 1.0%. The EU is not too far from recession as is most of the advance world economies.

Retailers will be well advised to consider the depth of their stock holdings and the ranges they are ordering in. Consumers are already shopping for lower cost alternatives and that will only accelerate after October when fuel prices rise steeply and will continue for at least 12 months.

Recession options for the next UK Prime Minister

With two candidates vying to be the next leader of the Conservative party and, at least until the next General Election, the UK Prime Minister the choices facing them when the come into office on the 5th of September are unenviable and whoever wins is going to find it tough to keep an increasingly impoverished electorate onside. The IMF warns that help with fuel bills and soaring food prices will have to be balanced with taxes or spending cuts:

Targeted fiscal support can help cushion the impact on the most vulnerable, but with government budgets stretched by the pandemic and the need for a disinflationary overall macroeconomic policy stance, such policies will need to be offset by increased taxes or lower government spending.

– International Monetary fund

Cutting spending is never popular as there is always someone wanting to use services that will make their voice heard and increasing taxes is something no Conservative Prime Minister ever wants to do.

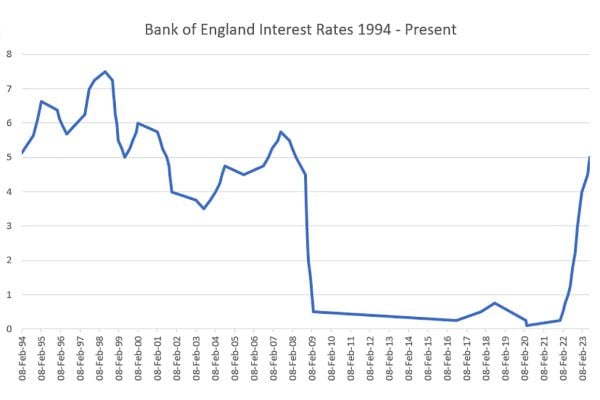

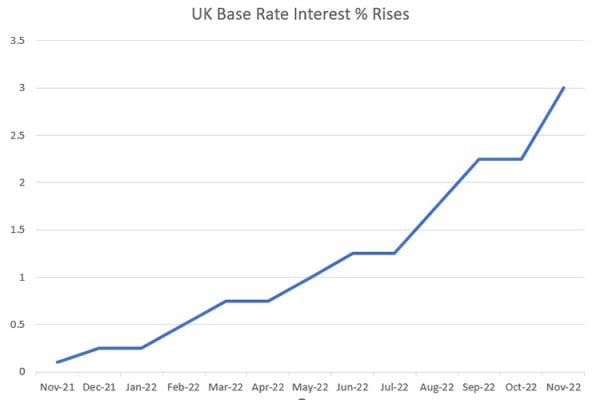

With the Interest rate rise announced yesterday, Andrew Bailey, Governor of the Bank of England, has been explaining that their overriding goal is to bring inflation back under control to 2% in the medium term. The Governor has said he understands the pressures on household finances and acknowledges that inflationary pressures are expected to dissipate over time but in the short term a shock to the economy will, the Bank forecasts, lead to a shortened recession that bites less than if they take no action.