At The Delivery Conference this morning, new research was revealed from Metapack, ShipStation and Retail Economics, showing shoppers may have to pay more for less in 2023 as inflation adds £18.2 billion to UK non-food sales despite volumes decreasing by 4.9%.

UK non-food retail sales values are expected to hit £249 billion in 2023, but the 2.6% increase, or additional £18.2 billion of spending on the previous year, will be driven by rising consumer prices.

The Ecommerce Delivery Benchmark Report 2023, commissioned by Metapack’s operating company, Auctane, in partnership with economics consultancy, Retail Economics, included a survey of over 730 retail businesses across eight international markets. It found that 80% were planning to increase the price of products, with 40% suggesting rising costs will be the biggest challenge in 2023.

Cost pressures and shifting shopping habits

Retail brands are facing rising input and operating costs and with margins under so much pressure, it’s likely that some of these costs are being passed on to consumers, especially as merchants look for ways to find savings and preserve margins.

These challenges are matched by consumer concerns about the outlook for the economy and their personal finances over the year ahead, with 66% of consumers in the UK citing inflation as their biggest concern.

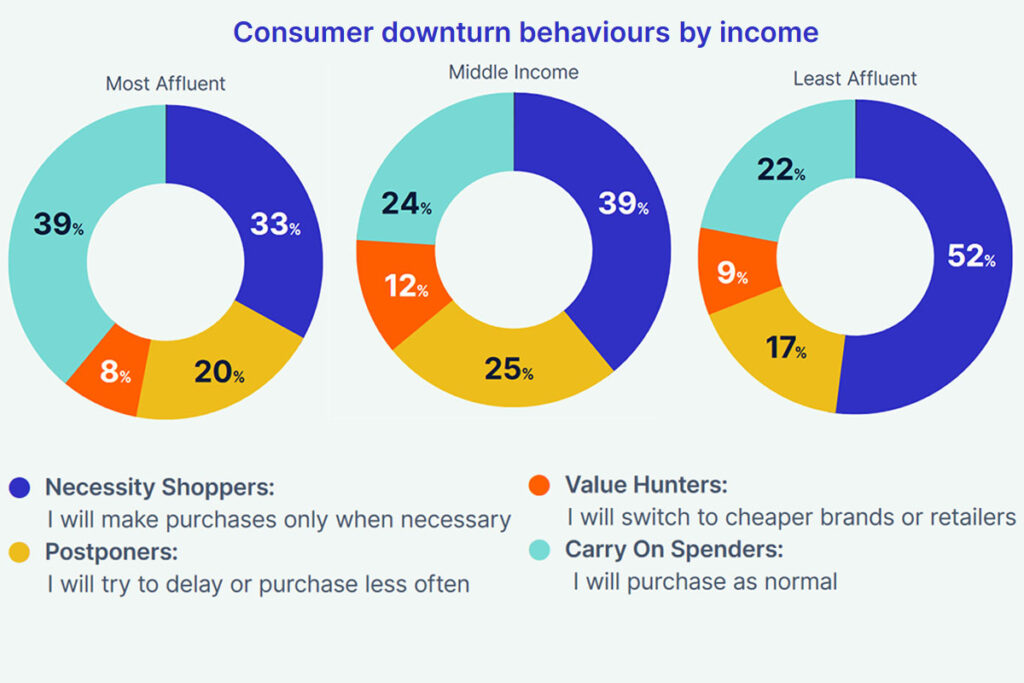

As a result, 74% of UK consumers plan to change their buying behaviours, with 34% stating they would only make purchases when necessary and 29% intending to delay or reduce spending.

As a result of consumers’ reported plans to cut back and adopt recessionary behaviours, UK retail sales volumes (units of products sold) are set to fall 4.9% in 2023 compared to last year. This underlines the fact that shoppers are simply having to spend more to get less for their money with retail inflation expected to hit 7.5% over the year ahead.

The research highlights that inflation is expected to add almost £260 billion ($319 billion) to retail sales in 2023 across the eight international markets included in the research.

Retailer expectations

However, many retailers remain optimistic about trading prospects in 2023, with more businesses holding a positive rather than negative view regarding the economy, and only 20% anticipating weaker consumer demand over the year ahead.

Consumer sentiment and economic projections are generally at odds with retailers’ expectations for the year ahead. Of those small enterprise retailers surveyed, 80% expect order volumes to be the same or higher (59%) in 2023, with a third anticipating order volumes to be 10% higher or more.

Keeping costs down will be the top priority for both retailers and consumers in 2023. As our research highlights, everybody will be looking to get the most bang for their buck from operating costs to delivery costs and product costs. From offering a greater choice of delivery options, having a resilient carrier infrastructure, to providing delightful deliveries experiences, we believe retailers who are able to provide the most value will be the ones who come out on top.

– Andrew Norman, General Manager, Metapack

Delivery priorities: cost over convenience

The research reveals that in 2023, the cost of delivery is expected to be the most important conversion factor impacting retailers. Almost 35% of consumers highlight cost as their biggest priority when it comes to delivery, as speed and convenience become less important. That said, operating cost pressures facing businesses may make this a difficult challenge. Over a quarter of retail businesses plan to increase the cost of delivery for their customers, while only 18% say they won’t increase the price of products, delivery, or returns this year.

As shoppers’ priorities shift towards value, our research shows that consumers would rather wait longer for delivery, or compromise on delivery location, rather than cost. Almost 30% of UK consumers reported they would happily switch to parcel lockers or click and collect (‘BOPIS’ – Buy Online Pick Up In Store) services for their online orders.

2023 is set to be a complex year for the ecommerce industry. As our research reflects, the economic backdrop is expected to have an impact on merchant operations and consumer buying behaviours. That said, through difficult times, innovation often emerges the winner, and we expect the same to happen this year. We believe omnichannel retail and delivery will become increasingly important as consumers switch between online and offline as they look for the best deals. Merchants who continue to invest and adapt in technology to suit the changing needs of their customers are the most likely to drive loyalty and do well.

– Mike Hayers, General Manager, ShipStation Europe

Sustainability and second-hand

Sustainability continues to be top of mind for many shoppers, with 79% stating they would consider green delivery options when ordering online. When going green, 38% of consumers are more willing to accept longer delivery times and almost 35% of consumers are likely to switch to out of home collection, rather than paying extra to offset emissions, with only 7% of shippers willing to consider the latter.

Interestingly, consumer perceptions around ‘second hand’ are also changing and retailers are responding to growing demand from consumers for economical and sustainable alternatives to buying brand new. Over a quarter of consumers plan to buy second hand or use online resale marketplaces more often in the year ahead. This rises to as high as 40% among consumers who will likely change their behaviour in response to economic pressures. This suggests that cost of living concerns may inadvertently accelerate the shift to a circular economy.

Category and channel shifts

Shopping behaviour will diverge across income groups and categories. With this in mind, luxury brands and discounters are likely to outperform at opposite ends of the market, leaving mid-tier retailers squeezed. But even for the most affluent, our research highlights that 61% still plan to tighten or cut discretionary spending over the year ahead.

Digging into this further, the research reveals furniture and homewares will be most impacted with 43% of UK consumers set to delay or reduce spending on these products. 35% plan to look to switch to cheaper brands when it comes to buying clothes, with 32% stating they would look for cheaper alternatives when it comes to electrical items.

One in three UK consumers plan to carry on spending as normal on health and beauty products – more than any other sector – with an additional 14% preferring to trade down rather than purchase less often.

Across all non-food sectors, our research shows a net proportion of consumers plan to shop more online than they did last year. As shoppers look for value, they may become more channel agnostic, regularly switching between physical and online to find the best deals. This could serve to accelerate the shift to a hybrid retail future that merges the best of physical and digital.

Retailers will continue to face a toxic mix of pressures this year as rising input and operating costs collide against a backdrop of weaker consumer demand, rising interest rates and shifting consumer behaviours.

These conditions favour those retailers who have strong balance sheets who can invest heavily in price, leverage data to target their most valued customers and win new ones, while efficiently utilising stores to provide a truly omnichannel proposition.

Those that carry high levels of debt, have weak pricing power and sit in the middle of the market could find life very difficult.

– Richard Lim, CEO, Retail Economics