Mirakl has been an amazing success story in recent years, as the goto platform for retailers including B&Q and Debenhams in the UK, to open a marketplace and welcome third party sellers onto their platforms. Now, they have secured a €100m Revolving Credit Facility valuing the company at an incredible $3.5 billion+.

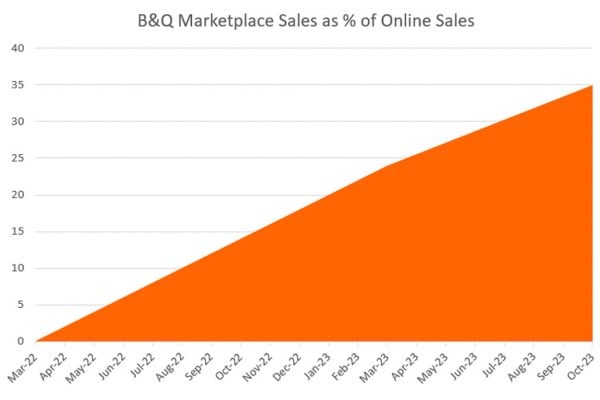

Both B&Q and Debenhams have seen strong growth in their marketplace sales, with B&Q reporting that 27% of online sales now go through marketplace (and that was within their first year as a marketplace!).

Additional Mirakl marketplaces in the US now include Madewell which gained the opportunity to explore new product categories. Beth Herget, vice president of merchandising at Madewell says that they use use marketplace retailers most effectively in the categories that we sell well ourselves, and have seen zero cannibalisation in their business since the launch, billing marketplace products as “Labels We Love”.

Baby Bunting has also just launched with 5,000 additional products from 20 retailers and plan to expand to 20k products from 150 third party sellers within a year.

The Revolving Credit Facility supplements Mirakl’s existing strong cash position, built on the company’s controlled cash consumption following series D and E fundraisings. The funds will be used to finance Mirakl’s growth, in particular by investing in its technology and completing acquisitions.

Mirakl has a strong track record of investment, both in acquisitions and organic growth, such as the acquisition of Target2Sell, the launch of its retail media business (Mirakl Ads) and its financial services business (Mirakl Payout) which had generated more than $135 million in annual recurring revenue.

There is little doubt that Mirakl will continue to assist retailers to open third party marketplaces at pace, as one of the fastest growing sectors in ecommerce. Just as retailers banded together in the physical world on high streets and then in shopping malls, by gathering ever larger numbers of retailers and increasing product selection online means great consumer loyalty to the brand and frankly more sales.

This latest debt financing is an additional milestone demonstrating Mirakl’s financial strength and greater financial maturity. Through the RCF, we will be able to carry out M&A transactions that will further strengthen Mirakl’s technological progress and the success of our customers’ marketplaces.

– Adrien Nussenbaum, co-Founder and co-CEO of Mirakl

We are proud to announce the signing of this RCF, which reflects the confidence of our banking partners in supporting our long-term growth strategy. This facility, with its flexible terms and competitive conditions, provides us with additional financial resources to meet our strong ambitions for growth and development.

– Eric Heurtaux, Group CFO of Mirakl

One Response

Maybe I am missing something here but they are celebrating the fact they got a loan?