Merchants that haven’t embarked on a significant Brexit plan should first concentrate on “people,” considers GFS commercial director on how merchants should prepare for Brexit. “They should ask themselves; how many people in the event of hard-Brexit will be eligible to still work for me? That’s an important step you need to make.”

Daniel Ennor, commercial director of GFS and managing director of GFS logistics, who has been working for the supplier for 12 years shares with Tamebay practical approaches merchants can introduce into their business models in the event of ‘hard-Brexit.’

Despite the commonly-used word ‘uncertainty’ in association with Brexit, merchants can prepare themselves to “all bets are off” scenario by understanding “how different potential exists from the European Union (EU) may affect them.” As he says: “Merchants can ensure that carriers they work with are authorised economic operator (AEO) approved. This essentially means that the transporter of products are known to customs and are likely to have a light touch regulation through customs. They should be also reviewing harmonised system (HS) code. Currently, if I’m a merchant that sells only in the EU, I currently don’t have to provide an HS code. In the event of a hard exit merchants will need to provide the minimum of an 8 digit HS code but more preferable would be the 10 digit HS code.”

Customers

Daniel puts down customer satisfaction in the post-Brexit environment to offering a variety of shipping options integrated with a Duty & Tax Calculator to give the consumer a truly transparent delivery experience. Options should include “tracked postal, deferred road services into Europe & express shipping. Locker and click and collect solutions will also help to minimise the reasons for abandoned digital baskets. In line with this again comes communication. As a merchant, you’re capturing as much information as possible to make sure that the carriers can communicate as efficiently as possible to your customer within the transit of any particular delivery. Nothing drives customers’ queries more than having a limited amount of communication.”

Expansion

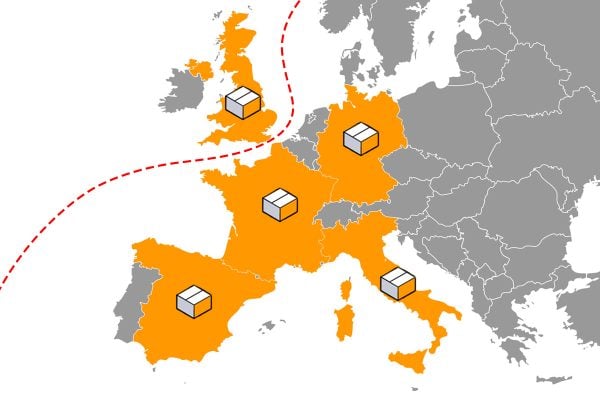

Merchants that focus on moving out of their base to establish themselves beyond their borders should aim to work with suppliers that have a local-market knowledge, explains Daniel. Bringing an example of the prevalence of solutions such as cash-on-delivery into the Middle East Daniel emphasises the need for sellers to also work with the right delivery suppliers which would add value to their businesses.

VAT

“It is also important to think about if you haven’t sold outside of the EU what’s the potential effect of the VAT evaluation on your products? The reality is when you’re selling into the countries other than the UK, once we do leave the EU, you’re looking at the challenges of managing VAT returns for all of those countries. You might also want to think about things like having a deferment account. If you want to avoid paying border taxes at the customs border that’s a potential opportunity for you.”

Duties and taxes

Customers are likely to abandon a purchase if they’re unable to see the transparency of costs right all the way through to the delivery point at a point of purchase, explains Daniel. As he says: “It’s very important for shoppers to see what’re the duties and taxes associated with any particular delivery that I may receive. There is a whole number of elements that go into making sure if you’re selling on marketplaces you can make the customer experience as seamless as possible.”

3 Responses

NIc Pic Dan!!

My take is that we need to wait for any final decisions/rules/laws being announced as right now all we can do is “worry” but that’s not very productive, right? 🙂

Vapid article wih no real advice. IF there are customs duties in future the only thing likely to help UK companies selling into Europe is setting up a business in Europe and holding stock in Europe. MY DPD account already has a £25 customs processing charge for European countries outside the EU including Norway and Switzerland. IF that charge were to be introduced for all EU countries that increase in costs would kill European sales stone dead.