Germany has introduced similar VAT laws to the UK, holding marketplaces jointly and severally liable for any VAT that merchants may not pay. Germany have also introduced VAT legislation effective from the 1st of January 2019 that gives them the right to see activity for all accounts on marketplaces. You can read the German § 22f Special obligations for operators of an electronic marketplace here with the net result that you will likely need to register for German VAT.

With this change, as you might expect Amazon, eBay and other marketplaces want to cover themselves and are requiring merchants to register additional business information.

Bescheinigung nach §22f UStG

eBay and Amazon are requiring all business sellers to submit a VAT certificate “Bescheinigung nach §22f UStG” which confirms the tax registration of the seller.

When to Register for German VAT

You will need to register for German VAT if you:

- You are a seller established in Germany.

- You are selling goods that are warehoused in Germany.

- You ship goods to private individuals in Germany from a foreign EU country where the goods are stored or delivered in advance. This applies for a total German turnover of 100,000 euros per year across all sales channels.

Dates you need to comply by

There are two dates set out in the legislation that you need to be aware of:

Merchants located outside the EEA

If you are located outside the European Economic Area, you need to register your tax certificate by the 1st of March 2019.

Merchants located the within EEA

If you are located within the European Economic Area, you need to register your tax certificate by the 1st of October 2019.

Brexit impact

Currently, we don’t know the status of the UK and whether will be be inside or outside the EEA after the 29th of March 2019, so a sensible precaution would be to register sooner rather than later.

Sellers who fail to register by the relevant dates on both Amazon and eBay will be blocked from selling to Germany in the future. It’s important to realise that this doesn’t just include selling on their German marketplaces, it will impact your ability to sell on other country sites if your listings are available to be purchased by German consumers.

Does this apply to all sellers, even those not VAT registered in Germany?

The German Tax Authority suggest that if you don’t have VAT obligations in Germany then you shouldn’t need to the new Tax Certificate.

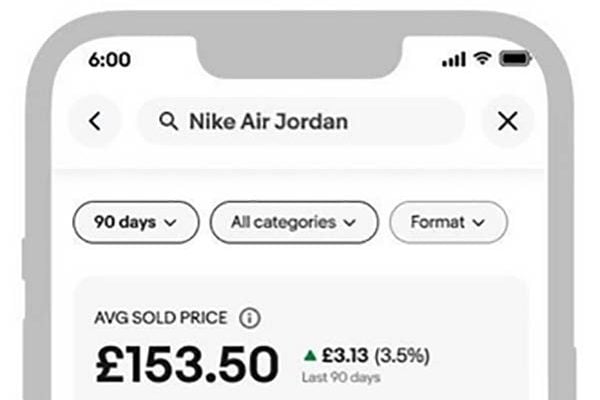

eBay

eBay’s language on their German VAT help page suggests that only sellers liable to pay German VAT need obtain and upload their tax certificate. If you are below the €100k selling limit, don’t hold stock in Germany and aren’t based in Germany than you may not need to register to continue to sell on eBay.

If you do need to register your tax certificate with eBay you can upload it here.

Amazon

Amazon’s language on their help page says that all Amazon selling partners fulfilling orders to or from Germany themselves or using Amazon FBA must obtain and upload their tax certificates. This suggests that Amazon are taking a harder stance and that if you want to sell to Germans on Amazon that you will have to obtain a Tax Certificate even if you don’t have to pay German VAT.

9 Responses

There is so much talk on the Amazon boards about this.

We haven’t received any notification from ebay or Amazon.

I was only alerted to the amazon page by a friend that had received an email from Amazon.

I was filling in the form BUT towards the bottom it shows “1)”

My confusion is below.

I am just a little English seller, just me literally. So am I supposed to find an “Authorised recipient” in Germany, whatever that is.

====

Traders with no residence or habitual abode, registered office or business management in Germany, in another Member State of the European Union or in a a country where the Agreement

on the European Economic Area applies, must provide the name of an authorised recipient in Germany when applying (section 123, Fiscal Code (Abgabenordnung)).

1)

======

https://www.berlin.de/sen/finanzen/steuern/downloads/umsatzsteuer/antrag-auf-erteilung-einer-bescheinigung-englisch.pdf

Unless Amazon are deliberately trying to eliminate all sellers doing under 100k into Germany, then they need to provide proper clarification on the rules.

The new law states this IS NOT a requirement for sellers who are based in the EU and sell less than 100k per year into Germany. This makes sense because the admin/paperwork for the German tax office would be an absolute nightmare for minuscule amounts of tax. This is why there ARE turnover thresholds.

Sellers located outside the EU have a ZERO threshold. You WILL need to register with German tax office.

The lack of clarification from Amazon is leaving sellers (ourselves included) as to where we stand.

We demand clarification because even our tax advisors and the German tax office are saying this is NOT REQUIRED. Why Amazon are being so vague is completely negligent.

To add to this, Amazon say they require a tax certificate even if you just use FBA (regardless of threshold or VAT status). However, some sellers (according to Amazon forums) have enquired with the German tax office, but were told that they can’t get the tax certificate unless VAT registered.

So basically Amazon is contradicting the tax office and leading to further confusion.

You should make it clear if we leave with no deal you don’t have to register if you are sending goods from the UK.

With the wording I have seen from Amazon, it appears that anyone, whether inside or outside the EU, would need to comply with Amazon’s demands.

For those inside the EU the need for proof is much further away, whereas those outside the EU need to comply by 1st March.

If we leave, god only knows.

I am sure our politicians have it all in hand and there is no need for us to worry.

(That’ll be the day)

I’m in the process of getting this tax certificate myself. Luckily for me, I already planned to register for VAT in Germany anyway, so for me, this doesn’t make any difference, BUT for many other Amazon sellers, it will.

Amazon asks ALL sellers to submit this because they don’t want to be held responsible and pay VAT on behalf of sellers. They can’t filter sellers based on their sales on Amazon alone because the seller could sell 30k EUR worth of goods on Amazon but at the same time, 80k on eBay and 20k on Etsy and altogether that is more than 100k threshold. So as I see it, Amazon asks every seller who wants to continue to sell to Germany to submit this tax document. They don’t want to take any chances (they do the same thing in the US – they charge Sales tax on behalf of sellers in multiple States now, no matter you reach thresholds or not).

Hi

I received a message in ebay ‘Avoid the suspension of your eBay account by uploading your German VAT certificate

From March 1, a VAT certificate is required to keep trading on eBay’

but I am from Morocco not in Germany

I have no stock in Germany

I only deal with suppliers in Germany

What should I do now?

This is required of me now

Check whether your business needs to register for German VAT.

If so, register with the German tax authorities and apply for a VAT identification number. In addition apply for a VAT certificate (Bescheinigung nach §22f UStG).

Enter your VAT identification number on eBay, so we can display it on your eBay.de listings (as required by the law) here.

Check that your business name and VAT identification number in your eBay account matches those on your VAT certificate (Bescheinigung nach §22f UStG). Also, please make sure that your certificate carries an official stamp by your tax office

Upload your certificate (Bescheinigung nach §22f UStG). .