Emily Ross is a startup founder, strategic marketer, and search marketing professional. She speaks worldwide—online and off—on innovation, entrepreneurship and technology and today looks at Google Shopping.

Follow her on twitter on @emilyjaneross.

Google is making a bold strategic move to bypass Amazon and other online retailing giants by reconnecting consumers with sellers — amidst a crisis-driven tipping point for ecommerce.

Google launched “Froogle” – a play on the word ‘frugal’ – back in 2002. In 2007 it was given a complete makeover under the watch of Google’s VP of Local, Maps & Location Services, Marissa Mayer. The search giant then ditched the Froogle brand in favour of ‘Google Product Search’. In 2013, it changed name once again to ‘Google Shopping’. The rebrand came with a new business model, too: An auction-based system with 20% of the click price as fees.

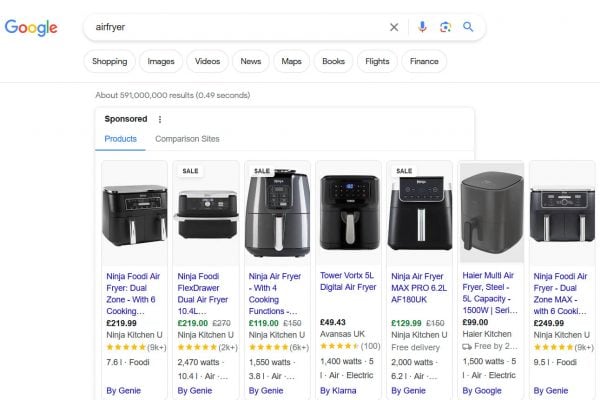

The ads on the Shopping tab (historically known as Product Listing Ads or PLAs) are very visual, with useful data points – including price and review scores – that are easily comparable across products. This is similar to how marketplace sites like Amazon and eBay work, with one key difference: Google Shopping ads bring shoppers and the transaction back to the seller’s website, rather than taking place elsewhere.

While Google Shopping offers a rich shopping experience and outstanding conversion rates, it is mostly hidden behind a nondescript ‘More’ section on the right-hand side of Google’s search interface. Making the most of this feature has remained a difficult tactic for ecommerce sellers because not only does it require ad spend, it also necessitates the creation and set up of a Merchant Center account; the verification of your website; and then the set up of product feeds. The Merchant Center is then linked to Ads and requires careful management. In short, there’s a lot of integration for a merchant.

As a result, the real winners to date have been performance display advertising agencies, who dominate the Shopping landscape with a whopping 35.1% market share of ad placements. This puts smaller sellers without the budget for expensive campaign management out of the running.

Then things got interesting!

Everything changed in April 2020 when, in a move to assist both sellers and consumers during the COVID-19 crisis, the aptly named Bill Ready, Google’s President of Commerce, announced that the company would add organic (free) listings to the paid-only Shopping tab, to help retailers connect with customers, without them having to spend money on advertising.

Google then announced in June that organic shopping ads would surface on the main page of Google search.

This might not sound like a big deal, until you consider that year-on-year Google ads revenue from Google ads was down 8% in Q2 of 2020, according to the WSJ—the first decline in Google’s 22-year history—at a time when ecommerce demand had literally never been greater.

“We’re bringing free listings to the main Google Search results page in the U.S., helping shoppers choose the products and sellers that will serve them best, from the widest variety of options”

In truth, Google has been experimenting with ads in knowledge panels off and on since 2013. Shopping ads (paid ones) started to appear in knowledge panel experiments back in 2019. Now they are free, and not only appearing in knowledge boxes, they would also, crucially, appear at the top of the page in the main page of Google search. This is clearly more than just an experiment. Google is making its move, and search advertising will never be the same again.

“Shopping ads … will appear separately at the top of the page, clearly marked like Google’s other ad units. Merchants can choose how to show up and shoppers can choose where to click.”

Speaking at the September 2020 ‘Think Retail on Air’ virtual conference, Justin de Graaf, Google’s Head of Research and Insights cited FOGO—fear of going out—as a major influencer on consumer behaviour. Citing the results of Google’s Ipsos COVID-19 survey, he observed that:

“17% of US holiday shoppers say they won’t be shopping in stores this upcoming season”

By putting the start of the shopping cart into search itself, Google is giving consumers the product comparison experience they appreciate on third party marketplaces, while simultaneously driving traffic direct (and sales) to seller sites.

This move comes at an inflection point in ecommerce where the global landscape is transforming rapidly, driven by crisis, overwhelming societal and behavioural change, and accelerated by mass adoption of virtual experiences.

More than 250,000 retail stores in the US have temporarily shut. In a single week, more than one million US retail workers were furloughed. The ecommerce opportunity is wide open, and all the big players—not just Google—are making their play. Shopify has issued a call to arms as defender of the Little Merchant; Facebook’s Instagram is festooned with impulse buys; and eBay and Walmart are gearing up for a near-apocalyptic retail season.

At the same September conference, Ready shared that organic shopping listings had resulted in a “70% plus lift in clicks” on Google’s Shopping property. The free listings move has, as intended, also dramatically increased the number of providers and the scale of inventory, fundamentally making the tab a better place for shoppers to find, compare and buy products. By removing the costs associated with the Shopping tab, it encouraged merchants of any size, no matter what their budget, to brave the merchant center setup. It’s a shot across the bow for marketplace sites like Amazon and eBay that have seen astonishing growth in revenue and scale over the past decade.

Sellers reliant on Amazon are extremely vulnerable

The big opportunity for online sellers is this: Shopping ads, unlike marketplace listings, drive traffic to seller-owned webstores—branded sites the seller controls. If you’re a seller, are many advantages to selling on your own site:

- You own your customer data

- The transaction doesn’t go through a third party which might sit on your cash for weeks

- The third party can’t display competing products

- You can implement drip marketing or messaging to bring buyers back to their cart and complete checkout

- You can sell to customers as you offer new products or services

- You can implement incentives such as sharing and affiliate commissions

Sellers reliant on Amazon are extremely vulnerable. The removal of selling privileges is painful and expensive, and performance metrics that can trigger removal are extremely tight. Direct-to-consumer sales brings a host of benefits, not only around logistics and transaction fees, but also in terms of building customer loyalty and relationships for future sales. However, in order to capitalise on the inherent opportunities of Google Shopping (not to mention a 30% uplift on conversion in comparison to text ads) sellers will still have to overcome the pain point of setting up a Merchant Center before they can see their products listed.

Integrations FTW – How Google is Rolling out Shopping at Scale

Google’s merchant center connects inventory from seller webstores to their adwords accounts. There are many steps required in order to set everything up, with plenty of potential pitfalls. The friction of merchant center management is a blocker to many smaller businesses, some of whom are going online for the very first time in response to COVID-19. Google has launched a number of strategic partnerships with ecommerce players that bypasses this friction, with third party integrations that enable sellers to push product feeds direct to shopping results.

This approach is a win-win-win scenario, for Google, SaaS partners, and sellers. By enabling product integrations, the benefits of Shopping can be easily rolled out to thousands of sellers at a time, bypassing many set up tasks of the merchant center, and enabling ecommerce sellers across multiple channels to push product feeds directly into Shopping in a fraction of the time it used to take.

In September the first of these integrations went live with xSellco, an ecommerce software provider with about 9000 ecommerce customers worldwide. Of note is the fact that xSellco’s products, which include the biggest repricing tool on the market and an AI supported ecommerce helpdesk, provide access to thousands of sellers using Amazon, eBay, Allegro, Woocommerce Shopify and Magento not to mention dozens of other smaller marketplaces and webstores. Strategic integrations like this one might in fact be the key to bringing customers back to retailer websites, and off marketplaces.

As Bill Ready pointed out in the closing minutes of the September Keynote address:

“With Covid, we’ve seen consumers shift their behaviour dramatically and the last few months it’s equalled the last ten years of e commerce growth, and so bringing those tools to retailers we know is now more important than ever.”

COVID Christmas is Coming

2020’s holiday season is set to be the most lucrative – and competitive – shopping period in ecommerce history. With COVID driving online purchasing to an all-time high, Google is making radical changes to its Google Shopping product that are a shot across the bow of entrenched ecommerce giants like Amazon. Google Shopping lets buyers start the purchase right inside search, increasing conversions 30% and gives the customer relationship back to the seller, but until now, the offering had been hidden and hard to deploy.

Now, by integrating with third-party ecommerce tools such as those from xSellco – an early integration partner in this effort – sellers can more easily adopt Google Shopping, build a direct relationship with their customers, and capitalize on the unprecedented online transactions that will happen this year.

3 Responses

Will only work if you can checkout with Google, people don’t want to go to several different websites and checkout. That’s why Amazon works.

If you can add products to basket from several different websites and then checkout through Google, it will work.

In my research I am seeing more and more e-commerce stores shifting their ad spend to google shopping. Which means it must be making them money.

Great post.