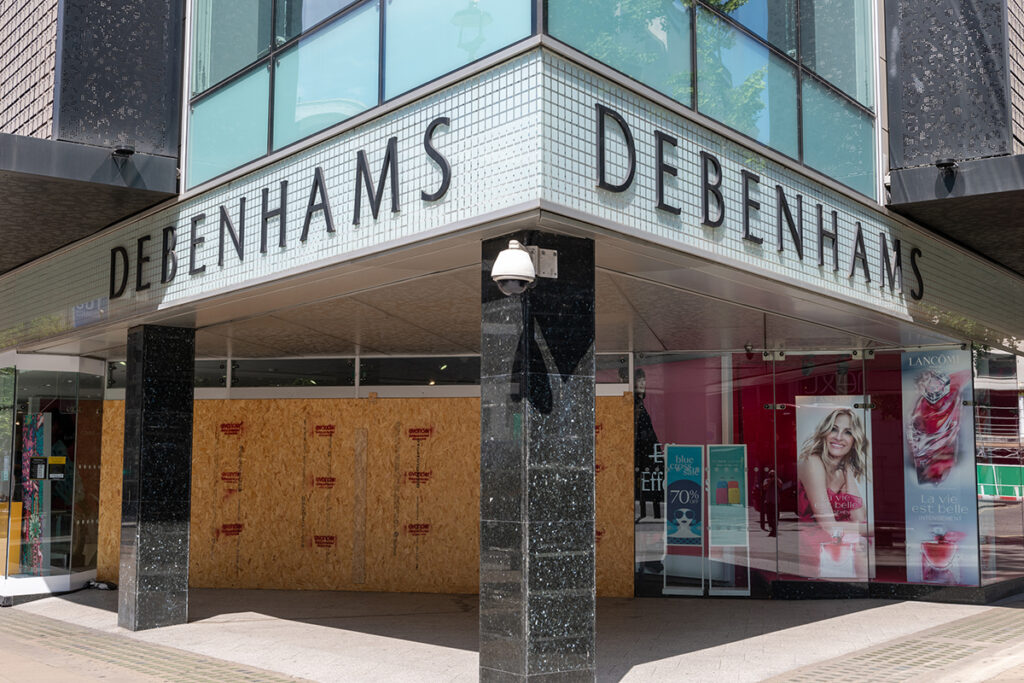

The Boohoo Debenhams acquisition isn’t so much an acquisition as cherry picking the online element of the retailer. Founded in 1778 by William Clark, as a single store in London it grew to 178 locations across the UK, Ireland and Denmark and now the remaining 118 stores and 12,000 staff are sadly to be consigned to the history books.

The high street is now in a bigger crisis than ever before and this was before the pandemic. The cloned high street, when it reopens, will be missing Debenhams as one of the largest anchor tenants and the Arcadia Group’s plethora of brands. Some Debenhams stores will open but only to clear stock as Boohoo aren’t interested in the inventory, stores and staff. What Boohoo want is the membership lists and the marketplace.

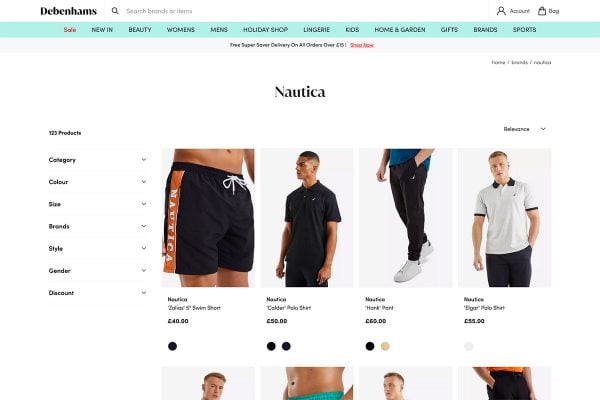

Many wouldn’t even have been aware that Debenhams operated a marketplace as it appeared an integral part of their offering but that’s the bit that Boohoo are buying. Debenhams is a long‐standing and leading UK fashion and beauty retailer with high brand awareness, and an established online platform with approximately 300 million UK website visits per annum. This makes it a top 10 retail website in the UK by traffic.

Boohoo, as a fast fashion retailer, are interested in adding beauty, sport and homewares to their fashion business and create the UK’s largest marketplace in these verticals. They are taking full advantage of the structural shift of retail to online and this £55 million will propel them to the top of the UK marketplace world.

The Boohoo Debenhams marketplace is expected to launch by summer. As there is significant inventory remaining within Debenhams stores which Boohoo don’t want, Debenhams will continue to operate their website to clear inventory and, when they are able to reopen as pandemic lock down is eased, the deal allows some stores to reopen to liquidate the stock remaining on the high street. They will then close their physical doors forever.

The new Boohoo Debenhams marketplace is likely to be of interest if you are an established brand with the beauty, homewares and sport verticals. There will be choice opportunities available throughout the year and someone somewhere will already be thinking about next year’s Debenhams Beauty Advent Calendar and who’s going to be supplying it.

Shape of Debenhams business

In Debenhams’ most recent financial year to 31 August 2020, its online business generated unaudited online net revenues of approximately £400 million, via the following operating models:

- Marketplace

Approximately 25% of the online revenue (primarily fashion and homewares)

- Beauty

Approximately 20% of the online revenue via a traditional wholesale model

- Own brand fashion

Approximately 25% of the online revenue (key brands include Maine, Mantaray, Principles and Faith)

- Wholesale inventory

Approximately 30% of the online revenue (bought from third‐party brands, including fashion, sport and homeware), which will not continue to operate under the Group’s ownership

Boohoo Debenhams aims

- Marketplace

Creating the UK’s largest marketplace across fashion, beauty, sport and homeware. The Group plans to expand the range of products sold via the Debenhams marketplace by maintaining existing marketplace brand relationships and adding new brands over time. The relaunched marketplace will also provide an exciting new route to market for the Group’s existing brand portfolio.

- Beauty

The Group will continue to operate the current wholesale model, but will also look to add new beauty brands via the marketplace model. Debenhams has 6 million beauty shoppers and 1.4 million Beauty Club members.

- Own brand fashion

Debenhams’ own fashion brands will be absorbed into Boohoo’s current brand portfolio and sold via the core Debenhams site and their own pure play websites. Boohoo plan to extend the Group’s brand portfolio through the acquisition of Debenhams’ pure play own brands including Maine, Mantaray, Principles and Faith

“The acquisition of the Debenhams brand is an important development for the Group, as we seek to capture incremental growth opportunities arising from the accelerating shift to online retail. We have developed a successful multi‐brand direct‐to‐consumer platform that continues to disrupt the markets that we operate in. The acquisition represents an exciting strategic opportunity to transform our target addressable market through the creation of an online marketplace that leverages Debenhams’ high brand awareness and traffic through the development of beauty and fashion partnerships connecting brands with consumers.”

– John Lyttle, CEO, Boohoo

“This is a transformational deal for the Group, which allows us to capture the fantastic opportunity as ecommerce continues to grow. Our ambition is to create the UK’s largest marketplace. Our acquisition of the Debenhams brand is strategically significant as it represents a huge step which accelerates our ambition to be a leader, not just in fashion ecommerce, but in new categories including beauty, sport and homeware”

– Mahmud Kamani, Executive Chairman, Boohoo