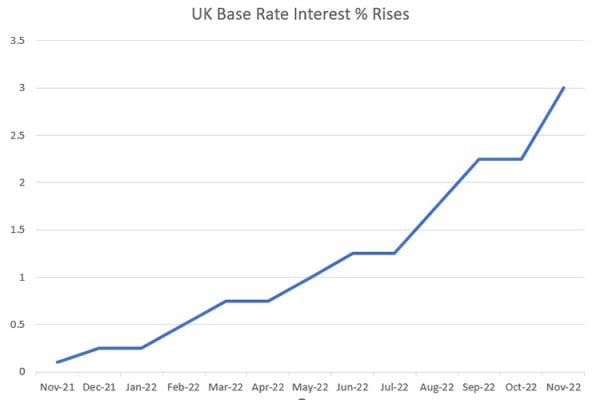

Yesterday the cost of borrowing rose to 1.25% as The Bank of England voted for an Interest Rates Rise of 0.25%. This was a majority of 6-3 votes by the The Bank of England’s Monetary Policy Committee (MPC), with the other three in favour of a steeper 0.5% rise.

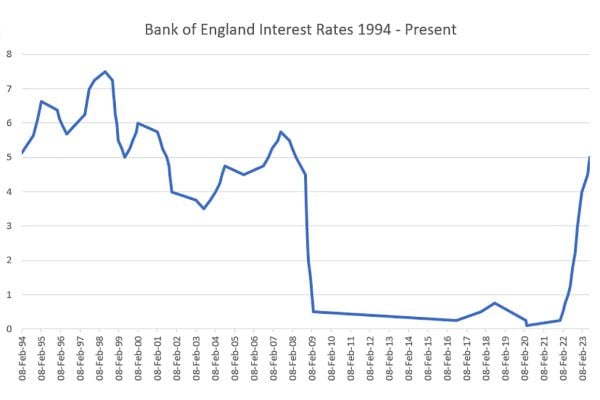

The Interest rates rise means that we have gone from 0.25% at the start of the year to a five fold increase and all the smart predictions are that we’ll be getting towards 3% or higher interest rates within a year. The Bank of England’s remit is to keep inflation at a 2% target and with fuel and petrol prices skyrocketing that’s impacting the entire economy, not to mention the cost of food and the far reaching impacts of Russia’s invasion of Ukraine.

Should The Bank of England take note of world events and reconsider their 2% inflation target? It appears not as they’ve specifically stated the inflation target is not subject to extraordinary events:

The MPC’s remit is clear that the inflation target applies at all times, reflecting the primacy of price stability in the UK monetary policy framework. The framework also recognises that there will be occasions when inflation will depart from the target as a result of shocks and disturbances. The economy has recently been subject to a succession of very large shocks. Monetary policy will ensure that, as the adjustment to these shocks occurs, CPI inflation will return to the 2% target sustainably in the medium term, while minimising undesirable volatility in output.

– The Bank of England Monetary Policy Summary, June 2022

While seeing your domestic mortgage interest rates rise by a multiple of five so far this year is pretty depressing, it’s nothing compared to the pain that businesses are feeling. Those carrying debt on their books will be heavily impacted and let’s not forget many businesses expanded rapidly during the pandemic – particularly online businesses – and if they are carrying debt forward their payments will also be multiplying. That means working even harder just to service debt repayments in an economy that’s rapidly slowing and unlikely to stabilise for the foreseeable future.