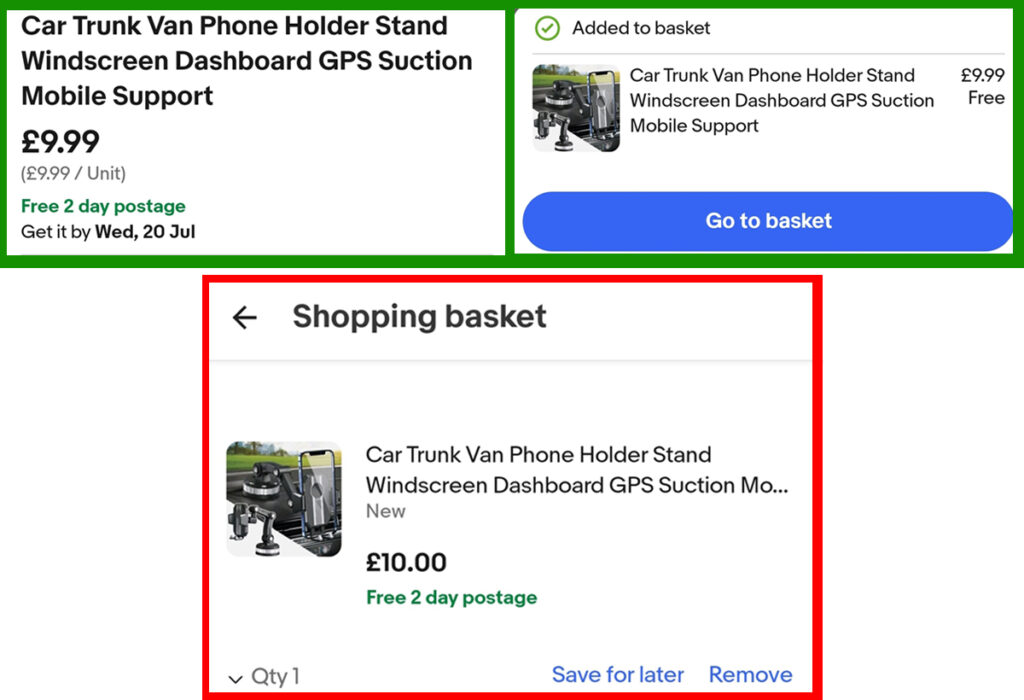

Spotted on eBay by a reader is a penny price overcharge event where the price of an item jumps from the view item page to the price you pay at checkout.

Viewing the item in question, the price is £9.99, but by the time you come to checkout the penny price overcharge takes place which means the price rises to £10.00. It’s only a penny, but what the heck is going on?

The three images above are screenshots we took of the purchase flow. The first shows the view item page, the second shows confirmation that the £9.99 item was added to the shopping basket, the third shows the item in the shopping basket but now the penny price overcharge shows a cost of £10.00.

There may be an explanation which is the result of a rounding error – the seller in question is Chinese registered and so eBay are obliged to collect VAT on the sale. Our thinking is that the price displayed on the listing is the original price listed but the proceeds of the sale the seller receives will be £9.99 less 20% VAT – £8.325. As we only deal in round pennies, that is probably being rounded to £8.33. Now, in the shopping basket eBay may be digitally holding on to the £8.33 price and then adding 20% VAT which comes to £9.996 and is then rounded up to £10.00. This theory at least explains what may be occurring, even if the outcome is unsatisfactory.

This kind of penny price weirdness isn’t entirely unprecedented and even made it into Superman 3…

We aren’t of course accusing eBay of purposefully undertaking the act of a penny price overcharge scam. It’s much more likely the innocent result of programming a complex financial transaction without fully taking into account potential rounding errors that look to have crept in. We’re guessing that the deduction of VAT in the seller pay out and a not quite corresponding collection of VAT for HMRC from the buyer is just an every day SNAFU that pleases no one, especially the buyer who feels like they’ve been bilked by a penny.

24 Responses

1p multiplied by what – a million transactions a day ?, £10,000 a day extra income. Kerching !

Nice little earner and I will bet my HOUSE that it’s not a mistake.

Why haven’t you approached eBay for a comment?