What does deflation mean for ecommerce? We asked Edd Hardy, Business Analyst at World First, for his comment.

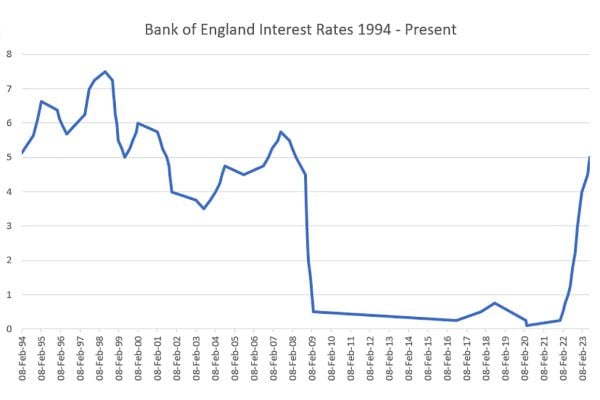

For the first time in over 5 decades, the basket of goods used to measure inflation in the UK fell on a Y/Y basis. This will come as no surprise to those who follow the index, after the Bank of England governor warned the UK would enter deflation around 2 months ago.

Where does this leave the broader UK economy? Sterling is around 5.8% stronger than this time last year and in the past 12 months there has obviously been a significant decline in oil and food prices. The subsequent effect on imports into the UK means that disinflation is piggybacking on every product that we bring in from abroad.

Furthermore as oil prices recover and last year’s declines fall out of the inflationary basket then this will become less of an issue. We must also remember that wages are now rising by 2% in real terms; great conditions for UK consumers to continue spending through the summer months.

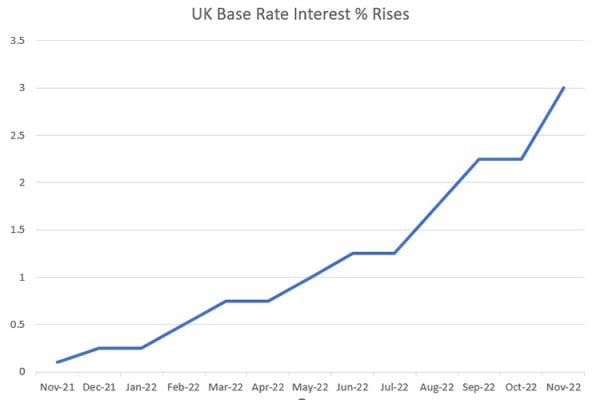

Sterling has weakened since the release this morning, slipping 0.75% against the dollar as markets have revised their expectations for a rate hike from the Bank of England further into the future – now pencilled in for early 2016.