There’s a lot going on in the global financial markets right now that’s directly relevant to ecommerce sellers. Especially those who sell abroad.

UK interest rates have stayed at a record low for a record period, Sterling is struggling and the Euro Referendum looms on the horizon. What do you need to know?

Chief Economist at World First Jeremy Cook told Tamebay:

“On balance last week’s meeting was never going to set markets alight coming a month before a Quarterly Inflation Report and 10 weeks before the electorate go to the polls to decide on the referendum.

Fears and uncertainties over the outcome and impact of the referendum campaign and the eventual vote on the UK’s membership of the EU have remained front and centre for the Monetary Policy Committee and there is little incentive for policymakers to stick their head above the parapet for hikes or cuts until the result is known.

Structured economic data has also been a depressant and it is likely that Q1 was the weakest in growth terms since 2013 with expectations that businesses and consumers may suspend spending and investment decisions through Q2 as the vote closes in.

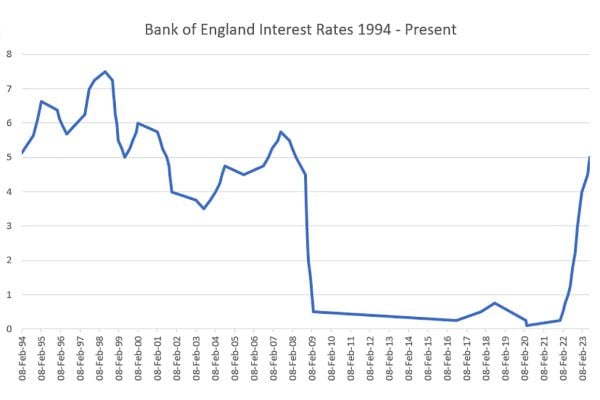

Interest rates are into their 8th year of sitting at 0.5% with markets pricing 8bps of cuts in the next 12 months and no increase in rates for 45 months – the beginning of 2020.

As we have said this week and before, sterling is dramatically undervalued on a trade-weighted basis – by as much as 10%. Net positioning remains extremely bearish and movements in options markets suggest that protection against sterling downside is a lot more expensive than it was in the lead-in to the Scottish referendum. A remain vote is the only thing that can rescue this.

The sooner the referendum is behind us, the better it will be for members of the MPC. November is the earliest meeting we could possibly see the first hike by a Bank of England dealing with a UK that remains part of the EU but this is very much contingent on strong wage and price growth.”

2 Responses

Would someone be kind enough to translate the penultimate paragraph into English?