Banks make money by charging interest on funds they lend you (overdrafts, loans, mortgages) and paying interest on funds you lend them (deposits, savings accounts). That’s generally how it works but it may all be about to change with the Royal Bank of Scotland (RBS) set to charge their biggest 70 odd customers for deposits from Monday.

Up until now RBS has charged investors 0% interest on mandatory deposits they’re required to make to cover trading positions. It’s expected that from Monday this week they’ll charge (instead of pay) interest on deposits although alternatives to cash such as bonds and securities will still be allowed interest free.

At this stage it’s just RBS’ biggest investor clients who will be affected. There’s no current indications that smaller businesses or consumers will be charged for money they have in their savings accounts.

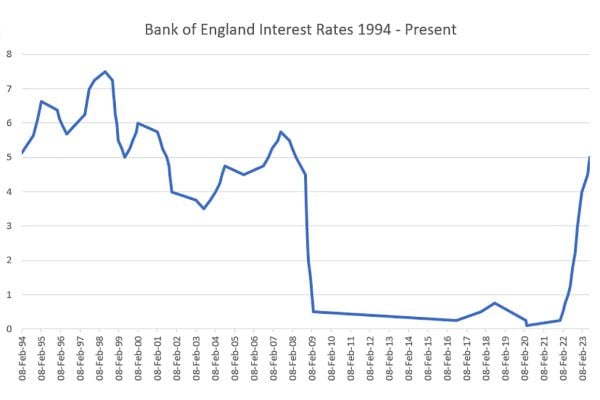

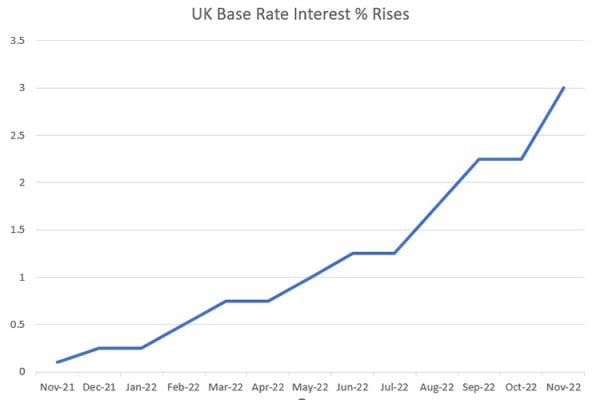

We are living in interesting times and having cash in the bank doesn’t really work for anyone when interest rates are so low. Is now the time to invest heavily in your business either with your own funds or with borrowing? There hasn’t been a better moment in our lifetimes to be a borrower rather than a lender and it looks likely that interest rates will be staying low for the foreseeable future.

Are you investing? If so are you using your own funds, a traditional bank or an alternative lender?

2 Responses

Note – big investor clients. High street banks dare not charge negative rates to householders. The Bank of England has recently reported the rise of cash in free circulation. The lower the interest rates the less incentive there is to put cash into accounts. If the public were charged for deposits, savings accounts would be plundered.

The next story will be RBS are the first bank to have all its depositors withdraw their money and have a run on the bank.