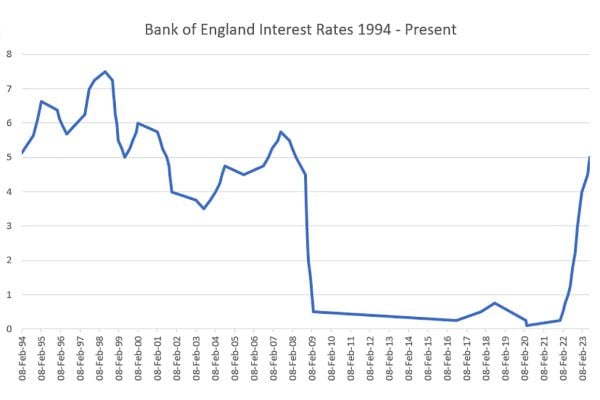

It’s steady as she goes at the Bank of England. Interest rates will remain unchanged with a base rate of 0.25% and the quantitive easing programme stays capped at a total of £435 billion pounds. The bank’s Monetary Policy Committee voted 6-2 in favour of leaving rates and QE unchanged.

The Bank of England said of the decision: “All members agreed that any increases in Bank Rate would be expected to be at a gradual pace and to a limited extent.”

Governor of the Bank of England Mark Carney said uncertainty regarding Brexit was a factor: “It is evident that uncertainties about the eventual relationship are weighing on the decisions of some business. We see it directly in the macroeconomic numbers, investment has been weaker than we otherwise would have expected.”

Commenting on the Bank of England’s interest rate announcement, Edward Hardy, Economist at WORLDFIRST, says: “Alongside expectations, the Bank of England held interest rates at a record low 0.25%. Despite inflationary pressures building, the committee chose to continue stimulating the economy through their bond purchase target and rock-bottom borrowing costs. The immediate threat of higher interest rates (which would, in turn, bring sterling strength) has passed, allowing UK exporters to continue to use their exchange rate-induced price advantage when selling abroad.”

“While importers are still suffering the headache of higher foreign supplier and equipment costs, if the economy improves further in the second half of this year we could see a stronger pound, as the Bank warned that tightening may be required to bring inflation back down to target. Such a move by Carney and his board would trim some of the concern from the bottom line of your average SME importer.”

How is the uncertainty of Brexit affecting your investment and strategic decision making? Does your approach reflect the general reluctance to invest in the immediate future that the Governor talks about?