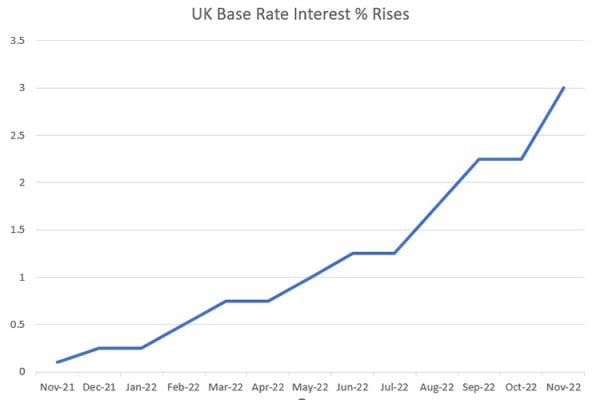

The Bank of England’s Monetary Policy Committee has raised interest rates from 0.25% to 0.5% which will impact everyone who has a mortgage or needs to borrow money to fund their business (or personal life).

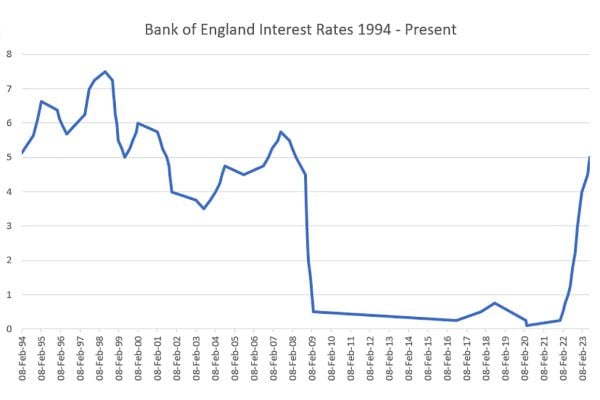

This is the first interest rate rise in a decade. In 2007 interest rates peaked at 5.75% before dropping rapidly to 0.5% in 2009 and then a final drop to 0.25% in August 2016. A whole generation of home owners and businesses will have never before experienced a rate rise, although in reality it’s only returning to the level of a year ago so the short term impact shouldn’t be overly harsh for most people.

However the average domestic mortgage of around £175,000 will now cost households around £22 per month extra (if the home owner is on a variable rate deal) and whilst this is a relatively modest amount it will put further pressure on already tight household budgets.

Brexit effect on Interest Rates

Much of the Monetary Policy Committee’s decision to raise interest rates is based around Brexit which is having a noticeable impact on forecasts. If you would like to learn more about the likely impact on your business then sign up for our Brexit webinar which is being held on the 16th of November with finance experts WorldFirst

“The decision to leave the European Union is having a noticeable impact on the economic outlook. The overshoot of inflation throughout the forecast predominantly reflects the effects on import prices of the referendum-related fall in sterling. Uncertainties associated with Brexit are weighing on domestic activity, which has slowed even as global growth has risen significantly. And Brexit-related constraints on investment and labour supply appear to be reinforcing the marked slowdown that has been increasingly evident in recent years in the rate at which the economy can grow without generating inflationary pressures.”

– Bank of England

How do you think the interest rate rise will impact you and your business? In many cases for businesses it’s not the interest rate rise itself which will affect decisions but the longer term reality that having seen one rise, further interest rate rises could be coming down the line and it is this that will cause jitters for those considering taking on long term finance unless it’s on a fixed rate deal.

One Response

They should have raised these a couple of years ago before Brexit. We as a country are all just in another pile of debt again, most my friends are up to their eyeballs.

It will not just be homeowners (many who have spent far too much on their properties) that will feel it, rental market will be hit also. We rent a property out and have always kept the rent the same since 2009, it only a few quid and the tenants have done well but still, others will use it as an excuse to really hike rents.

Again it is another squeeze on people, were getting tax rises in Scotland by the looks of things also.

This is all very well, but you are simply not seeing people being paid properly in the UK. If your want your economy dominated by multi-national tax avoiders and a few home grown ones in our sector using LVCR avoidance from Switzerland, the employers who would like to raise wages simply cant as they are playing on an uneven field. Spread the wealth just a bit it is all that is needed.

You can tell things are slower already out there and I think this will be for the foreseeable future. Smaller business is going to have to box smart.