Google have joined Amazon as one of the large online businesses that don’t fancy paying the Digital Services Tax introduced in the UK. It is intended to fairly tax large businesses which are domiciled overseas, with revenues above £500m, and operate paying less that what is perceived as their share of tax based on their revenue generated from their UK operations.

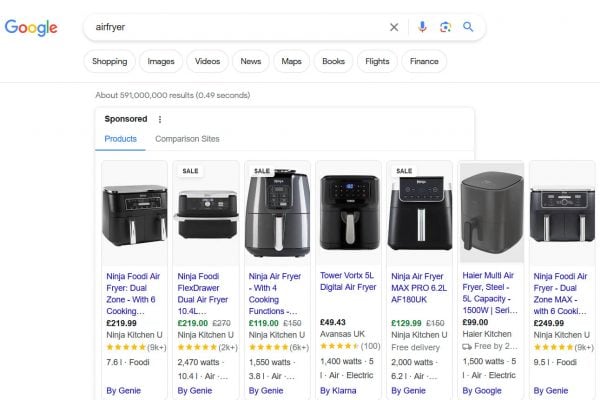

Like Amazon, Google assert that an international solution is needed and when the UK slapped a 2% digital services tax on their business they weren’t too chuffed. The tax was even dubbed the ‘Google Tax’, but that doesn’t mean they want to pay it and so Google will start passing the tax on to advertisers from November according to CityAM.

“Digital service taxes increase the cost of digital advertising. Typically, these kinds of cost increases are borne by customers and, like other companies affected by this tax, we will be adding a fee to our invoices, from November. We will continue to pay all the taxes due in the UK, and to encourage governments globally to focus on international tax reform rather than implementing new, unilateral levies.”

So far, eBay are the only large internet business who have done what many might say is the honourable thing and say that they’ll stump up and pay the tax themselves. It was, after all, intended to be a tax on large overseas based Internet Giants who don’t pay much in the way of Corporation tax in the UK. All the businesses regularly assert that they pay all taxes due in all jurisdictions that they operate, but eBay are the only business who have stepped up and say they’ll pay, with Amazon and now Google deciding to pass the tax on to the small businesses that rely on their services to scrape a living.

By passing the tax on to their small business customers, Google will largely avoid paying any of the Digital Services Tax but it adds additional cost to their customers (that’s you if you advertise with Google!). Far from being a way to level the playing field, the Digital Services Tax (with the exception of eBay) is fast indirectly increasing the tax burden of small businesses. 2% on top of your Google advertising might not sound much, and in the grand scheme of things it’s not. But start adding up what you spent with Google last year, add on what you spent with Amazon, take two percent and you’re probably in the region of a very nice summer holiday being deducted from your bottom line that’s now going to be re-charged to you so that the Internet Giants don’t have to pay themselves.

Next year, when the large internet giants Corporation Tax bills are once again disclosed (undoubtedly at very low amounts compared to their UK revenues) watch out for them to declaim loudly that they also paid 2% of their UK revenues as Digital Services Tax.

Then remember that they didn’t pay the Digital Services Tax, they simply collected it from you.

4 Responses

It’s sneaky from Google, because they are just hoping advertisers don’t notice it. Ultimately, any business paying attention is going to change their targets and work backwards. A 500% ROAS target become a 510% target. A £45 CPA target becomes £46. That’s how it will work for my clients. They will all be made aware that what they see is not what they get within the ad interface anymore and it just hurts Google’s brand because they are now no longer transparent or up front in their costs.

Google are banking that many business won’t pay attention. But my clients are paying attention and Google will be paying for this one way or another, at least with my portfolio.

Google & transparency ? Lol

Back in the old days they even had this corporate motto “don’t be evil”. Says it all.

The government doesn’t care who pays the money, as long as they get it.

Remember the ban on credit card charges?

These were simply passed on to customers in other ways, or else credit cards were refused.

HMG itself is the worst offender.

They banned credit card payments to government for road tax and other payments.

But remember, this tax is designed to “help” the high street, which won’t see a penny of it.

And politicians wonder why nobody trusts them.

This tax has really put those tax dodgers back into line. Next, we will be hearing stories of how much tax they pay and how they recently paid 2% more than everyone else.

The department that deals with this kind of thing should be split from HMRC, called somthing else and actually have people you arnt completely useless working in it.