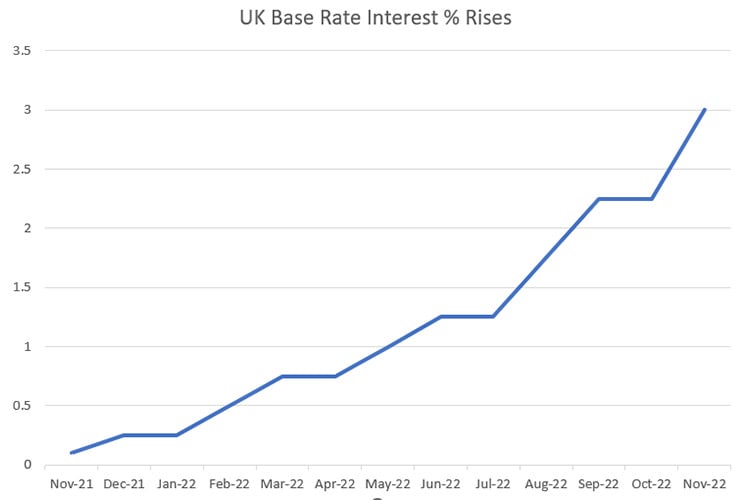

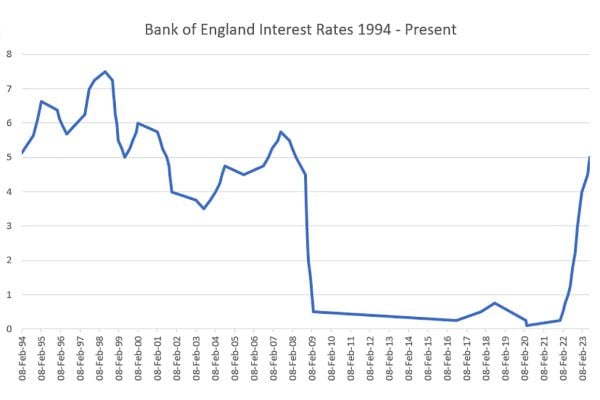

The Bank of England’s Monetary Policy Committee have voted by a majority of 7-2 to for a Bank Rate rise of 0.75 percentage points, to 3%. This is the highest Bank Rate since the bank crash 2008 when rates rapidly fell from a high of 5.75% and dived in a series of cuts to 0.5%.

Today’s announcement will mean everyone on a variable mortgage will see their monthly direct debits rise. Those on fixed rate mortgages will face significant increases in their outgoings when their fixed rates come to an end. Many will have taken out mortgages in the past decade and never experienced interest rates about 1% before so this is going to hurt.

It also means an almost immediate increase to all forms of borrowing from the interest on credit card debt to business loans and financing.

The Monetary Policy Committee voted by a majority of 7-2 to increase Bank Rate by 0.75 percentage points, to 3%. One member preferred to increase Bank Rate by 0.5 percentage points, to 2.75%, and one member preferred to increase Bank Rate by 0.25 percentage points, to 2.5%

As well as the Bank Rate rise, the Committee also believes the economy hit a downturn in the Summer and is forecasting recession throughout the whole of 2023 and into the first half of 2024.

Expect another Bank Rate rise next time the Monetary Policy Committee meet, they say “The majority of the Committee judges that, should the economy evolve broadly in line with the latest Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets.”